Various stakeholders met in a Bomet hotel for a one-day workshop that aimed to discuss ways to strengthen Saccos using the digital technology.

The workshop that delved into leveraging digital banking solutions to address challenges faced by SACCOs was organized by the Department of Cooperatives and Marketing in collaboration with Kwara Ltd, a technology-based core banking service provider for cooperatives.

According to Area Assistant Director of Cooperatives Fred Koskei, the event was convened in recognition of the fundamental role of Savings and Credit Co-operative societies (SACCOs) in Kenya’s socio-economic transformation.

“SACCOs are recognized as key agents in the socio-economic transformation of our country. They play a critical role in mobilizing savings and offering financial products that enable members to generate wealth and meet their social economic needs,” Koskei remarked.

Koskei stressed SACCOs are integral to the realization of Kenya Vision 2030, contributing to financial inclusion and providing impetus for investments across diverse sectors.

He however noted that despite their significance, SACCOs grapple with various challenges that hinder their ability to thrive and remain sustainable in the long term.

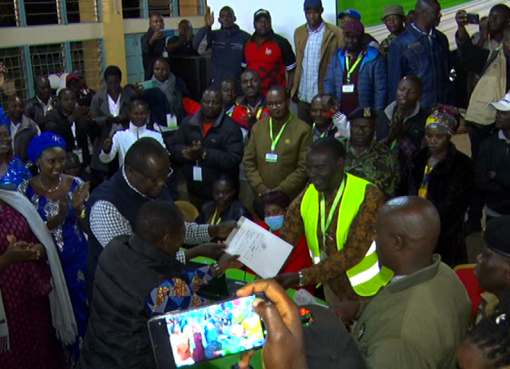

The workshop, attended by cooperative leaders from across the county and senior officials from the cooperative department, provided a platform to address these challenges head-on.

With a focus on digital banking solutions, participants explored how technology can revolutionize the operations of SACCOs, making them more efficient, accessible, and resilient.

Kwara Technologies, represented by Regional Sales Representative Ms Tabitha Wainaina showcased their cutting-edge solutions tailored specifically for SACCOs.

By harnessing technology, SACCOs can automate processes, improve data management, and offer a wider range of financial services to their members.

“As SACCOs embrace digital banking solutions, they can overcome existing challenges and unlock new growth opportunities,” emphasized Ms Wainaina adding: “We aim to empower SACCOs with the tools and technologies they need to thrive in the digital age.”

By Lamech Willy