In Kenya, women make up about 52 percent of the country’s population and about 30 percent of registered businesses are women-owned.

However, their financial inclusion in terms of assets remains slim, which makes it difficult for women-led SMEs (Small and medium enterprises) to access higher amounts of credit that have to be supported by collateral.

It is with these statistics in mind that women entrepreneurs in Thika were taken through an extensive financial capacity building workshop by the Kiambu County Government in collaboration with Somo Africa, a non-governmental organisation that focuses on empowering entrepreneurs by providing financial and market resource knowledge.

“Closing the gender inequality gap remains an economic challenge and necessity across the world. A lot of effort is being put into the gender agenda by governments, private sector and other institutions to narrow this disparity. In Kenya, women are applying themselves in every field to financially support their families and communities.”

One way to economically empower women is to fund female-owned businesses. This can only be done if favourable policies are created that support both public and private sector efforts. If we as a nation intend to fast-track women’s empowerment goals, financial investments and relevant technical support are required to expand opportunities for women to succeed in business,” said Wikister Awuor, programme training manager at Somo.

Research has shown that one in four women in Kenya is starting or managing a business. A study by Forbes further indicates that 96 percent of women have primary or shared responsibility for their families’ financial decisions, and 70–80 percent of all consumer purchases are driven by women through buying power and influence.

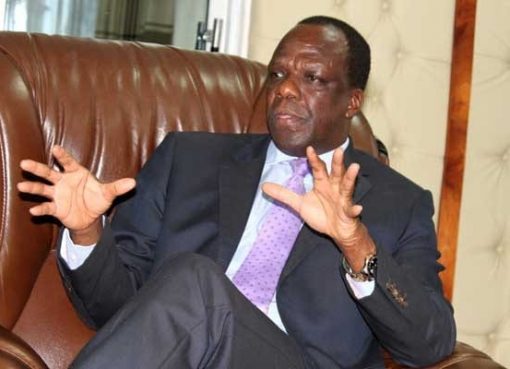

Speaking to the press, Dr. Ephantus Kihonge, the head of enterprise development in Kiambu County, said that women own and lead roughly 30 percent of all SMEs in Kenya, and SMEs account for 70 percent of employment worldwide. In emerging markets like Kenya, these businesses contribute up to 45 percent of total employment and 33 percent of GDP.

The public sector has an equally important role to play in addressing the constraints and biases that hold back women entrepreneurs and providing opportunities that help them grow. The Government is currently putting in place policies that promote female entrepreneurship to increase women’s access to capital and networks that will enable them to realise their entrepreneurial aspirations. We intend to partner with the private sector to create an entrepreneurial ecosystem that promotes gender equality and women’s economic empowerment,” he said.

The participants were SME’s drawn from different sectors such as agribusiness, food and manufacturing and were taken through a series of training, mentorship and business pitching tactics.

“Through the Buruka training programme, the participants learned core business skills like strategic planning, marketing and financial management. They will be able to apply these skills through experiential learning with mentors from the local business community,” said Awuor.

Esther Wanjiru, who operates a tailoring business, said the training had given her the ability to think innovatively in running her clothing design business through use of digital tools that allow her to follow trends and learn from anywhere at any time.

“I have also received seed funding that will enable me to expand my business, which means I will be able to employ and train two or three tailors to help me with the growing demand of customers that are visiting my business. This would not have been possible had I not attended the workshop,” said Wanjiru.

She urged businesswomen in the area to step out of their comfort zones and attend the workshops when opportunities arise.

By Hellen Lunalo