A majority of small businesses in Kisumu County are owned by the adult population, a new study has revealed, reporting that the low youth involvement in entrepreneurship is largely influenced by inaccessibility to loans and a lack of capital investments.

While 51 percent of Small and Medium Enterprises (SMEs) are managed by the old folk, only 49 percent of the Small and Medium Enterprises are youth-led in Lake County, with 34 percent being male-driven and 15 percent by female entrepreneurs.

This is according to the Kenya Small Firms Diaries (SFD) research that was jointly conducted by the Financial Sector Deepening (FSD) Kenya and the Financial Access Initiative (FAI) research center.

FSD Kenya Director Anne Mutahi stressed the need for financial service providers to improve their services through customized credit facilities tailored for small entrepreneurs and women.

Mutahi made the remarks during the launch of the SFD report in Kisumu City on Friday.

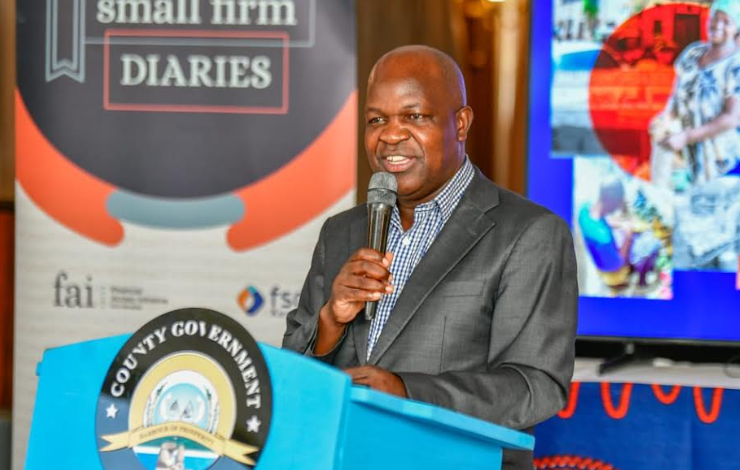

Kisumu Deputy Governor, Dr. Mathew Owili, speaking at the same event, lauded the report’s findings as a milestone in heralding policy changes set to address the financial needs and challenges faced by small firms in the area.

He emphasized the crucial role played by small businesses as the engines of economic progress and the heart and soul of local communities.

“This is the engine of growth for the Kenyan economy. It is my firm belief that this report makes an important contribution to policies that support SMEs,” stated Dr. Owili.

The Deputy Governor urged the banking institutions to leverage digital technology to advance financial inclusion programs by developing specialized products for small businesses.

According to Owili, the county government had invested massively to integrate value chains in the agricultural and financial sectors to allow SMEs to scale up their operations.

“One of the challenges cited by particularly female-owned SMEs is the lack of collateral that banks require. The credit information systems, movable collateral registries, and warehouse receipting can also be leveraged more effectively to reduce risks and enable businesses to use their information assets and stock to access credit,” Owili stated.

The research was conducted in Nairobi, Kisumu, and Kwale Counties, where most small-scale businesses are operated by women who depend hugely on table banking financing.

By Robert Ojwang’