The Kenya government has signed the Regional Liquidity Support Facility (RLSF) Memorandum of Understanding with the African Trade Insurance Agency (ATIDI), to facilitate collaboration in identifying, developing and implementing renewable energy projects across the country.

Regional Liquidity Support Facility, a joint initiative of ATIDI, the KfW Development Bank and the Norwegian Agency for Development Cooperation (NORAD), is a credit enhancement instrument provided by ATIDI to renewable energy Independent Power Producers (IPPs) that sell the electricity generated by their projects to State-owned power utilities.

ATIDI will issue liquidity instruments backed by cash collateral from KfW and NORAD, to renewable energy Independent Power Producers or private transmission companies for a maximum tenure of up to 15 years while each RLSF policy will cover up to a maximum of 12 months’ worth of revenue for the project.

The memorandum will also enable ATIDI to engage with IPPs in Kenya with the expectation that advanced hydro, geothermal, solar, and wind projects may benefit from this instrument in the near future.

The RLSF cover which is available to renewable energy projects of up to 100 MW, and privately financed transmission projects not only focuses on leveraging the country’s abundant natural resources to generate clean and sustainable energy, but also to reinforce power generation and transmission capacity.

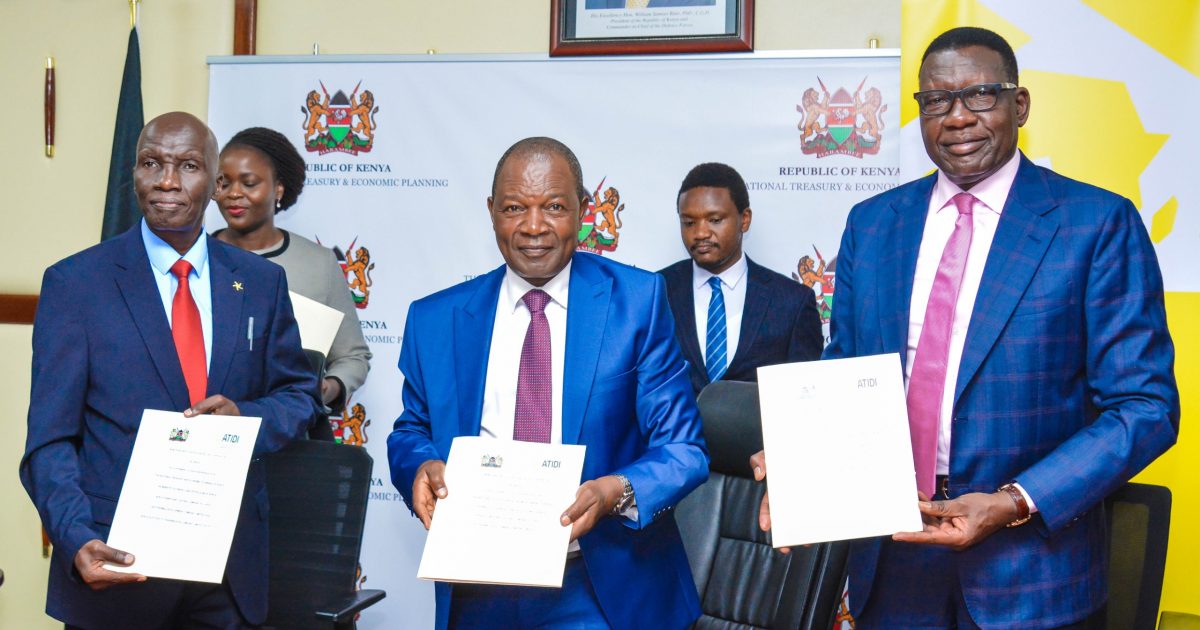

In a press statement sent to newsrooms, the Cabinet Secretary, Ministry of Energy and Petroleum Davis Chirchir who was speaking at the signing ceremony said the collaboration between ATIDI and the government through the country’s power utilities that will include Geothermal Development Company, Kenya Electricity Transmission Company Limited and Kenya Power and Lighting Company should make a positive contribution towards the attainment of the country’s long term development agenda the Vision 2030.

Chirchir said, “This will ensure Kenya becomes a newly-industrializing, middle-income economy, providing a high quality of life to all its citizens in a clean and secure environment,” adding that the collaboration would also increase energy access and greater reliability.

In his remarks, the Cabinet Secretary, National Treasury Prof. Njuguna Ndung’u said the government encourages the private sector participation in the financing of key infrastructure, such as the development of renewable energy power plants and key transmission infrastructure.

“The provision of RLSF policies will hopefully enable more projects to advance whilst reducing the need for government-backed credit enhancement tools,” stated Prof. Ndungu.

ATIDI Chief Executive Officer Mr. Manuel Moses said they were looking forward to investing in Kenya’s energy sector, noting that the company’s support for new projects in Kenya via RLSF would build on its historical involvement in the country’s energy sector, having in the past supported projects such as the Lake Turkana and Kipeto wind projects.

“We are pleased to be crossing this key milestone with the Kenya government. Not only does this send out a positive message to project developers and lenders, but also to other prospective stakeholders,” he said.

Kenya becomes the tenth ATIDI member state to sign the RLSF MoU after Benin, Burundi, Côte d’Ivoire, Ghana, Madagascar, Malawi, Togo, Uganda and Zambia.

To date, RLSF policies have been issued in support of six renewable energy projects in Burundi, Malawi and Uganda enabling total financing of USD 207.5m and a total installed electricity generation capacity of 136.3 MW.

ATIDI was founded in 2001 by African States to cover trade and investment risks of companies doing business in Africa. The company also provides political risk, credit insurance and, surety insurance.

By Bernadette Khaduli