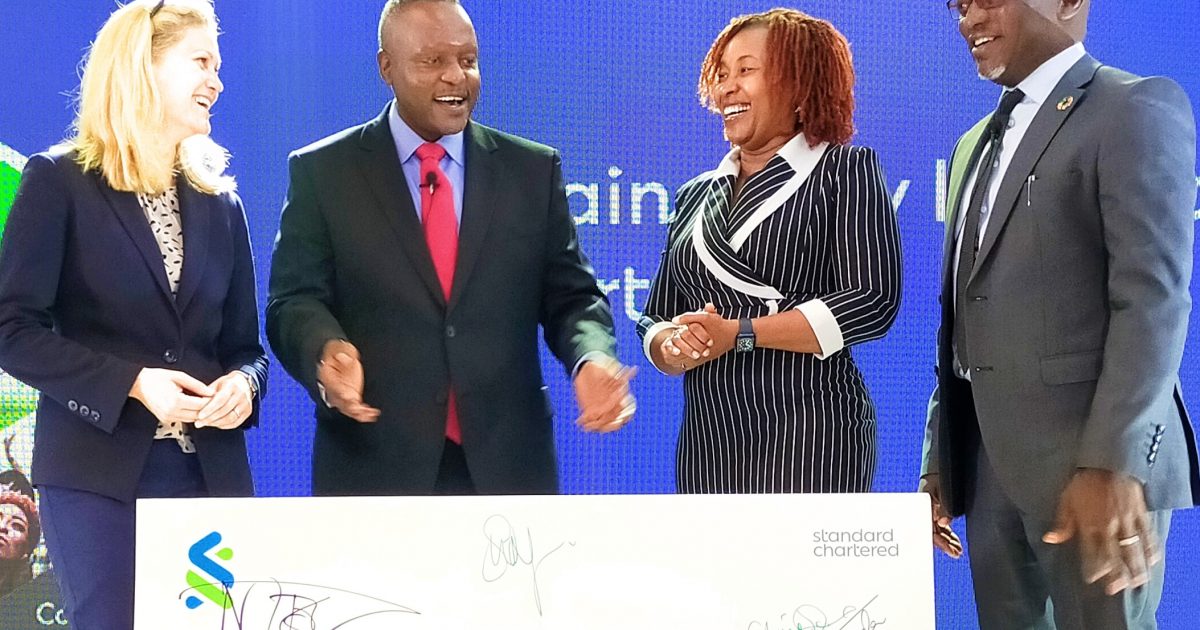

The Standard Chartered Bank Kenya Limited has partnered with Davis and Shirtliff Company towards the implementation of renewable energy and water treatment infrastructure in the country.

The Bank Managing Director and Chief Executive Officer, Kariuki Ngari said through the partnership, the Bank would provide funding to Davis and Shirtliff to assist in providing the latter’s clients with lower costs access to energy and water treatment solutions.

“In 2021, our total commitment towards investing in job-creating sectors amounted to Sh136 billion in outstanding loans and advances whereby we prioritized making investments into the manufacturing, energy, water and ICT sectors,” said Ngari.

Speaking during the launch of the Standard Chartered Bank 2021 sustainability Impact Report on Monday at the Standard Chartered Head office in Nairobi, Ngari said during the period under review the Bank focused on three key sustainability pillars which include sustainable economic growth, creating a responsible company and investing in the community.

He said the Bank is encouraged by the alignment the sustainability pillars have with local and international impact ambitions. “These sustainability pillars have allowed us to provide much-needed funding, donations, infrastructure and skills throughout the year in line with meeting the goals set under the United Nations Sustainable Development Goals,” said Ngari.

The MD added that Standard Chartered Bank has invested heavily on her employees to ensure that they serve their clients safely and effectively, while working from home or office. “As a result, over 70 percent of our staff worked from home throughout the Covid pandemic and continue to do so to date,” he stated.

Ngari said that the Bank has developed an approach to sustainability within the two client business segments of Corporate Commercial and Institutional Banking (CCIB) and Consumer, Private and Business Banking (CPBB) with the aim of increasing revenue generated from sustainable sources.

By Mwereza Sorotina and Jedida Barasa