SasaPay, a digital payments service provider, has unveiled new strategy as the company targets to increase its customer base both in Kenya and the diaspora market.

The new strategy centres around the provision of cutting-edge seamless financial solutions which will ensure a secure payment experience for a diverse range of businesses including financial services sector players, banks, Saccos and digital lenders, as well as SMEs in general trade and healthcare facilities.

The company envisions playing a pivotal role in the Kenyan economy by acting as a bridge between businesses and capital providers.

Further, the firm announced that it will facilitate quick, affordable access to working capital for businesses thus spurring business growth.

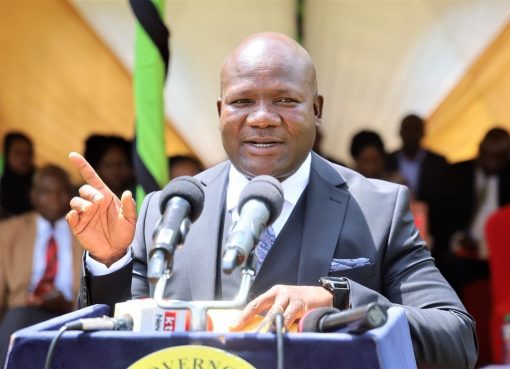

“Through our rebrand, we aim to redefine the role of the payments and act as the meeting point between Kenyan businesses and their customers. Key to this will be empowering them to operate more efficiently to accelerate growth,” SasaPay Chief Operating Officer and CEO Daniel

Njoroge said.

Njoroge stated that the firm shall apply its AI-based innovative technology to enable businesses upscale by providing timely and accurate data to capital providers that will in turn fasten its decision making in funding SMEs.

This way, he continued, the businesses will grow, provide more employment and hence provide more households with dignified lifestyles.

Further, the firm unveiled models that will focus more on strategic partnerships engineered to enable its customers derive more value from their wallets.

“Customers are assured of solutions in Savings, Lending, Investments and automated payments,” maintained Njoroge.

According to the CEO, SasaPay plans that SMEs will no longer pay any fee to get paid viaSasaPay wallets, instead, customers shall see their wallet balances earning them interest through collaborative partnerships with financial institutions in line with the firm’s philosophy of Shared Prosperity.

“Similarly, individual users will enjoy the most competitive transaction charges in the market and will see their wallet balances automatically earning them interest when not transacting.

SasaPay users shall also be able to Shop and Pay later through its model dubbed “Shop Now Pay

Later”,” he added.

Speaking at the event, SasaPay Chairman Dr John Munyu disclosed that the company is also eying the diaspora market with seamless transfer of funds from the diaspora to Kenya and cross-border payments from Kenya.

He added that the firm also eyes transaction for platform for Kenyans in the diaspora to empower them transact with their families, business interests and investments in Kenya seamlessly from wherever they are in the world.

“The latest CBK’s FinAccess report shows that usage of mobile money rose from 28 percent in 2009 to 81 percent in 2022,” said Munyu, as he noted that the proportion of Kenyans who use two or more financial services simultaneously has quadrupled, from just 18 per cent of the population in 2006 to 75 percent in 2022.

In his closing remarks, the CEO Njoroge said that SasaPay seeks to establish Kenya as the gateway to Africa through a robust financial ecosystem.

“We are connecting SasaPay to diverse payments gateways across the world to ensure an individual or a business on the SasaPay platform can do business or any form of payment transactions with anyone from any part of the world,” he reiterated.

By Michael Omondi