Kenya Union of Savings and Credit Cooperatives limited (KUSSCO) wants the defunct municipal councils which were succeeded by the county governments and state owned entities to remit the defaulted sum of Sh.3.2 billion.

According to KUSSCO the former municipal councils failed to remit recoveries from payrolls to the Saccos to enable them operate efficiently.

Non-remittances by the defunct councils amount to Sh.1.4 billion while those from state owned enterprises are Sh.2 billion.

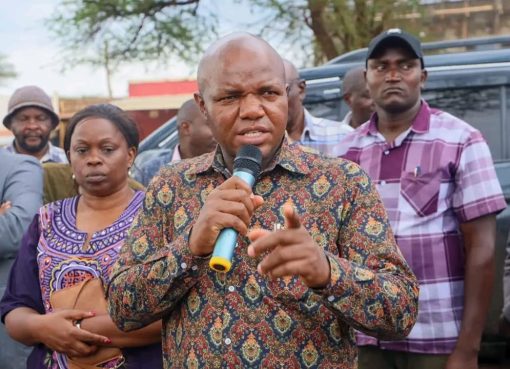

Speaking in Mombasa during the official opening of the 8th Annual Sacco Leaders Convention, KUSSCO Group Managing Director George Ototo said that the arrears have derailed the development of Saccos in the country.

Ototo noted that Saccos play a vital role in development and personal economic empowerment thus the need for organizations to commit to statutory obligations.

“As per the law through corporate societies Act cap 490 sections 35 which empowers the commissioner to freeze accounts of the offending entities that are not remitting deductions to the Saccos,” he said.

He added that they can also use the technique of negotiation to help Saccos recover the money from the offending entities.

Ototo said there are over ten entities that have defaulted which pushed them to do a press release that enumerated the offending institutions.

He noted that there are some other private sectors which owe Saccos some remittances.He said plans are underway to integrate government programmes in the bottom-up economy such as the hustler fund and integrate the Sacco business model to ensure citizens are reached with the right facility.

“Saccos are looking at how they can finance the agricultural sector of our economy through the small holder system of farming,” he added.

Ototo has also asked members to ensure they have stronger systems and incorporate the software space and most of the banking and other channels of financial services to be properly vetted.

He added that they are also trying to train Saccos to ensure that the service providers in terms of channels and integrators are institutions which are credible enough and encourage members to report issues of cyber-attacks in their systems.

He noted that partnership with service providers like Safaricom is helping them solve the problem of cyber security that has undermined the financial sector.

The MD urged the small Saccos to merge with others so that they become stronger as the model is based on membership.

When it comes to competition, Ototo said they provide a fair play as the Saccos are owned by members and not shareholders in which members are given a chance in decision making as they can be elected as officials.

By Chari Suche