Policyholders Compensation Fund (PCF) has disbursed Sh.93.18 million in claims to 778 policyholders of three collapsed insurance firms dating back to June 30, 2023.

Beneficiaries include 724 former clients of Resolution Insurance Company who have so far been compensated Sh.82.21 million. Insurance Regulatory Authority (IRA) placed the firm under statutory management in April 2022 after it ran into financial headwinds and was unable to fulfill its obligations.

The Fund has also compensated claims worth Sh.9.02 million to 45 claimants of Concord Insurance which collapsed in 2013 and another Sh.9.02 million to 9 policyholders of Standard Assurance which collapsed in 2008. The two firms are under liquidation and their licenses have since been revoked.

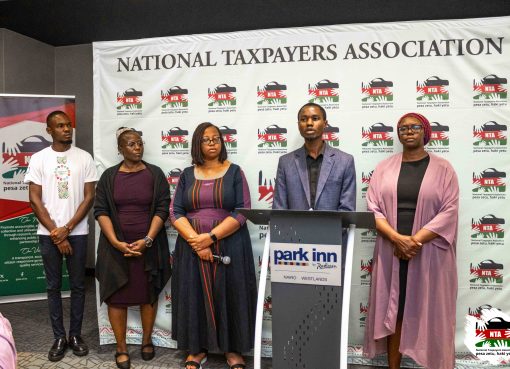

Rosemary Kavili, Deputy Director, of Corporate Communications at PCF appeals to policyholders with outstanding claims from the collapsed insurance firms to file claims within two years to be eligible for compensation from the kitty.

“We will traverse across all counties with a target of calling upon the public to come forward and lodge their claims with PCF for those members of the public who had claims with Resolution Insurance Company Limited -Under Statutory Management and Standard Assurance Company -Under Liquidation,” she emphasized.

Ms Kavili made the remarks during the opening of a five-day sensitization campaign for various stakeholders held in Kisumu County on December 4 – 8.

“PCF was established in 2005 to provide compensation to claimants of an insurer that has been put under statutory management or whose license has been canceled. This also aims at increasing the general public’s confidence in the insurance sector,” noted Ms Kavili.

The fund, Ms Kavili revealed, has accumulated Sh19.1 billion in levies from insurance companies and policyholders to be utilized in compensating the affected clients in the event an insurance firm collapses.

Insurers and the policyholder are required to each contribute a 0.25 percent levy on the premiums underwritten towards the fund.

Currently, PCF awards a maximum compensation of up to Sh250,000 per claim of general insurance.

However, creditors with higher value claims are expected to wait until the Company’s property and assets are auctioned through the liquidation process to be paid their dues.

Ms Kavili further, noted that IRA has also issued a green light for PCF to initiate the processing and effect compensations in the coming year to the policyholders of the United Insurance and Blue Shield Insurance – both under statutory management.

Other insurance companies that have shut down operations in the last two decades include Access Insurance Company, Kenya National Insurance, Stallion Insurance Company Ltd, Liberty Insurance, and Lake Star Insurance Company

The rising trend of business failure in the insurance industry was attributed to insurance fraud, underpricing of insurance products, poor corporate governance practices, poor investment, and economic downturns and global shocks.

During the campaign dubbed ‘PCF Mtaani’, PCF targets sensitizing the media, insurance agents, boda boda riders, and matatu owners.

Other stakeholders include the Deputy County Commissioners, Chiefs, business community, Kenya Union of Post Primary Education Teachers (Kuppet), Kenya National Union of Teachers (Knut), women, youth, and religious groups.

By Robert Ojwang’