A report released by the Petroleum Institute of East Africa (PIEA) has cited the current political uncertainty as one of the main issues that will affect the petroleum industry resulting in high prices in the coming days.

PIEA together with the NCBA Bank yesterday addressed trade issues that will affect the industry including the high and rising domestic inflation and the strengthening of the US dollar that is impacting the cash flow.

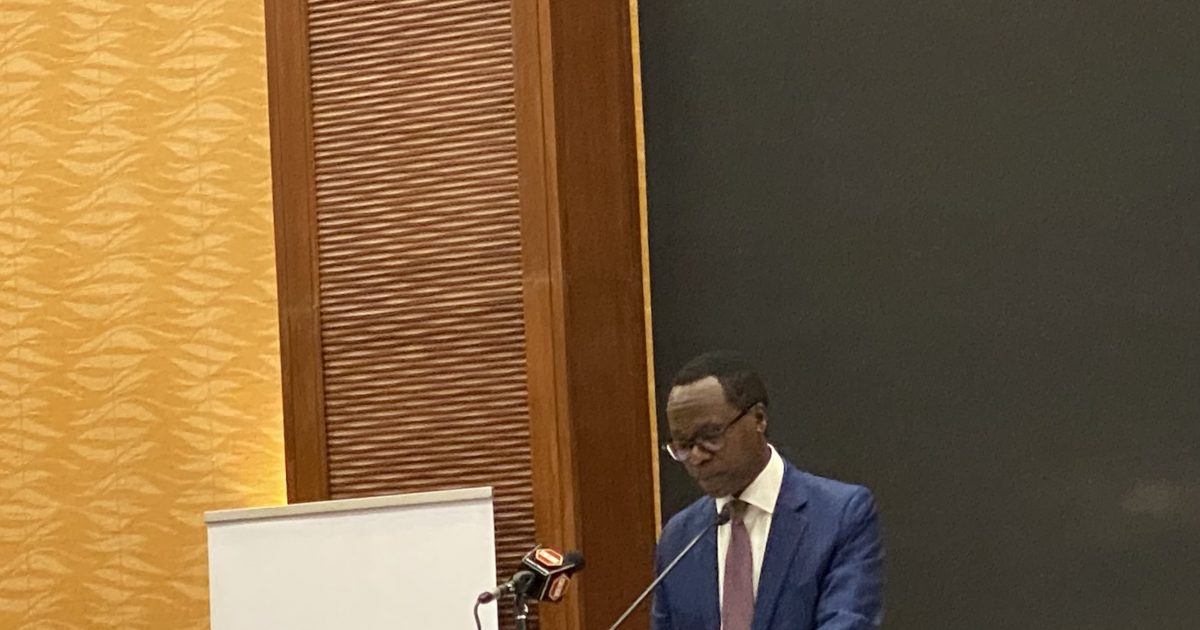

Speaking during a briefing at a Nairobi hotel, the Ministry of Petroleum and Mining Principal Secretary (PS) Mr. Andrew Kamau, stated that the government’s plan to raise gas to Sh185 per litre was prohibited but instead it raised by only Sh5 compared to other countries which have gone up to Sh200 per litre because of the current dire situation in the in the world.

“In Kenya, for the last one year, we managed to keep the prices of the gas as they are partly because of some foresight that we had in 2020 when the prices were low and we increased the price by Sh5 so that we can keep it in a kitty,” said Kamau.

NCBA Managing Director Mr. John Gachora said that the Russia-Ukraine conflict has deflated the country’s economy.

“As Europe turns to the United States and the Middle East for oil supply, the changes will result in a high insurance shaping, financing and compliance cost for players across the value chain,” Gachora said.

He announced that the free energy trade has been dramatically fading after Russia’s invasion of Ukraine, and the resulting Western sanctions of the former with Europe in a vertical decision to cut off its dependence on Russia.

Gachora lamented about the price of American Dollars tripling in value and its demand that indicate a significant rise as traders who used to ask for 100,000 dollars now asking for 300,000 dollars.

“NCBA has continued to support its customers very strongly and those customers who need the Dollar currency will be given in a week,” Gachora said.

The PIEA report demonstrates that despite the impacts caused by the pandemic, the economy of the country remained resilient with slight growth in the manufacturing, agricultural transport and communications sectors.

The report further explains that the retail outlets grew from 48.6 percent in 2020 to 49 percent in 2021, however resellers dropped from 26.5 percent in 2020 to 23.9 percent in 2021.

By Alain Christian and Abdiaziz Mohamed