The National Commercial Bank of Africa (NCBA) has unveiled its highly anticipated half-year financial results posting a profit after tax of KES 9.3 billion in the year ending June 30 2023.

This represents a 20.3 percent increase compared to Sh 7.8 billion reported during a similar period last year where the group registered a profit before tax of Sh 12.4 billion representing 11 percent growth up from Sh 11.2 billion.

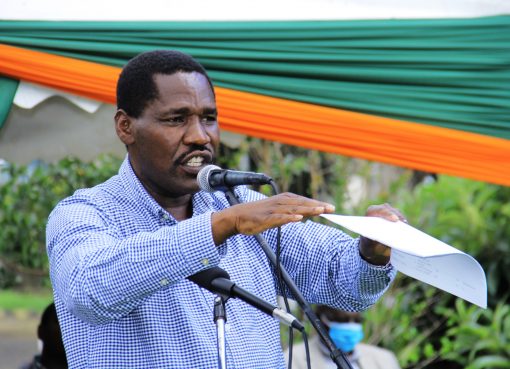

When announcing the half-year financial results, NCBA Managing Director (MD) John Gachora said amidst a landscape marked by economic fluctuations, the bank’s performance shines as a testament to its strategic acumen and resolute commitment to excellence.

Gachora said with a keen eye on both fiscal growth and customer-centric innovation, the bank’s numbers revealed a narrative of resilience, adaptability and unwavering dedication to its stakeholders.

He said the underlying growth trends in bottom-line profitability remained solid compared to 2022 driven by an increase in operating income and a decline in loan impairment charges by 21 percent.

“However, the group’s operating expenses were elevated by 24 percent year-on-year on the back of inclusionary pressures and continued investment in the current 5-year strategy which comes-to a close in 2024,” Gachora said.

He noted that this strong operating result is attributable to a consistent focus on the company’s strategic priorities, saying that the group’s strong performance enabled the Board of Directors to recommend an interim dividend declaration of KES 1.75 per share.

Gachora also noted that the group’s first half of the year performance was significantly boosted by the contributions of the regional subsidies (Tanzania, Rwanda and Uganda) which collectively delivered a profit before tax of KES 1.4 billion.Affirming that in Kenya there is continued growth in the core business, Gachora credited, “This year, we have open branches in Kenol, Murang’a, Chwele, Kahawa Sukari and Eastleigh with a plan to open Migori, Rwaka and Wote branches within the month.”

Equally, the MD revealed that the Group currently boasts of a network of 90 branches across 24 counties in Kenya with other branches in 15 countries regionally.

According to Gachora, NCBA recognizes that its license to operate is accredited by the communities it serves and this year alone, over 300 students from primary, tertiary and university institutions benefited from its 2023 education, mentorship and financial innovation sponsorship initiatives.

He pointed out that the Group, with a number of partners in government, private sector and learning institutions has so far planted over seven million trees as its Corporate Social Responsibility to reforestation through the environment and natural resources citizenship pillar.

Gachora said through the NCBA Golf series that invested over KES 50 million in golf sports, the bank has seen a significant milestone in promoting sports and uplifting the social and economic livelihood of communities.

“Recently at the World’s largest Junior event attended by 55 countries and held in Pine Hurst USA, Kenya was proudly represented by 12 junior players who qualified through an NCBA Golf tour,” he revealed.

The MD noted that while the macro environment remains challenging, particularly the rising inflation and forex pressure, NCBA Group’s regional employee footprint of more than 300 professionals remains committed to delivering financial solutions that help customers explore the changing microeconomic environment.

“A resilience and strong banking sector performance will support credit availability for customers in both the private and public sectors, which will in turn boost investment and tax revenue for the nation,” he said.

By Samson Nkooma and Okal Kevin