The County Government of Mombasa is formulating a raft of legal frameworks to improve the ease of doing business in the Port City of Mombasa.

The County Executive Committee Member (CECM) for Trade, Tourism and Culture Mohamed Osman says they plan to sign a Memorandum of Understanding (MOU) with the Kenya National Chamber of Commerce and Industry (KNCCI) to deepen their collaboration.

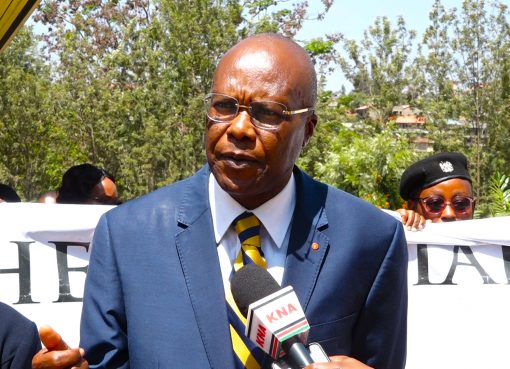

“Our primary objective is to have a conducive environment for the businesses to thrive. From last year, our Own Source Revenue (OSR) has moved from Sh3.5 billion to Sh4.4 billion, which is a big stride. It is because we can interact with our business partners,” said Osman during a breakfast meeting hosted by KNCCI Mombasa Chairman.

The CECM stated that Public participation on the Market Management and Street Vendors bill has been concluded and awaits enactment in the County Assembly.

“That is a bill that wants to bring order and sanity. We have done our mapping and found out that we have around 10,000 street vendors on our streets. These are informal traders, our primary objective is to grow them to be formal traders,” he said.

The Department of Trade will provide linkages to financial institutions for the vendors to be recognized and be able to access loans.

“Once we have that bill, we will able to have vending zones to allow the traders to sell their wares with social amenities. They will be restricted zones, that are areas we will allow to do business but within timeframes and non-vending zones like the CBD,” explained the CECM Osman.

KNCCI Mombasa Chapter Chairman Aboud Jamal urged business people to embrace partnerships in their businesses, and innovative ideas to navigate their ways.

“The Chamber is playing a critical role, especially partnering with Mombasa County Government in just trying to ensure we create a very conducive atmosphere. We want to hear more from the business persons to hear the challenges they are facing,” said Jamal.

The Consulate General of Uganda in Mombasa Paul Mukumbya says they are keen to enhance trade and investment relations between Uganda and Kenya.

The forum, he stated provides a platform to attract Kenyan traders to the Uganda market.

The Assistant Vice President of the Commercial International Bank (CIB) Kenya Limited Soliman El Ashkar said Egyptian firms are setting base in the country due to the impressive trade balance between Egypt and Kenya is about Sh83 to Sh90 billion a year.

He noted that Egypt imports mainly tea from Kenya and Kenya imports gypsum, papers, plastics and sanitary wares from Egypt.

“Part of our mandate as CIB is to grow the trade between Egypt and Kenya. Part of what we do is if a Kenya producer has something that they would like to offer to the Egyptian market, we will connect them with potential buyers and Kenyan importers who want to source something we will also connect,” stated El Ashkar.

CEO AAR Insurance Kenya and East Africa Justine Kosgei, said they have curated products for KNCCI members to increase insurance penetration to the traders. Compared to other markets in Africa like South Africa the CEO divulged that Kenya’s insurance is at 2.7 per cent.

In a bid to remove the barriers that prevent people from taking insurance, KNCCI will enjoy no waiting periods, and no pre-joining medical exams.

He cited a lack of knowledge, trust and affordability for low insurance uptake among Kenyans.

Through the partnership with KNCCI chapters, Kosgei says the uptake of insurance has improved among business people.

“We are glad to see thousands of SMEs that we have insured. We have hundreds of SMEs that we bring on board every month. We are trying to demystify that aspect that insurance penetration is low, we are trying to raise that so that we can fill that gap and ensure that everybody is protected,” he said.

He urged insurance firms to be innovative and create products that resonate with the people. The conversations around the Social Health Insurance Fund are also creating awareness of insurance needs.

By Sadik Hassan