The Kenya Union of Special Needs Education Teachers (KUSNET) has called on the Commission for Domestic Taxes to push for the revision of the legal notice that requires persons living with disability to renew their income tax exemption certificates every three years.

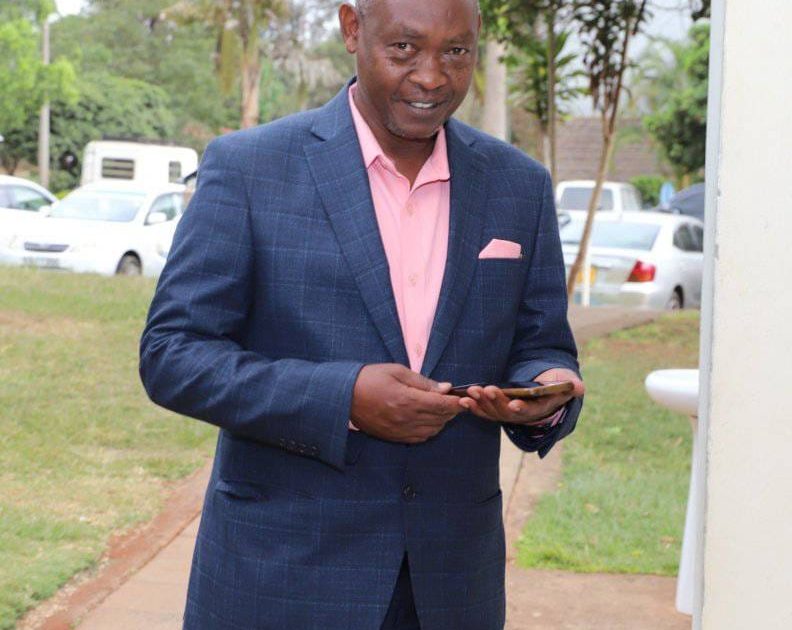

KUSNET Secretary General James Torome said the exercise to renew the certificate is too hectic for all employees living with disability who have to pass through a lengthy process to get the vital certificate.

Torome who spoke to journalists at his Narok office today wondered why this vulnerable group is forced to renew their certificates yet some forms of disability are irrevocable.

“The bigger question that rings around our minds is that there are disabilities that are irrevocable. If you push people living with disabilities to go see a doctor to make a recommendation after three years, we are saying that you are not giving justice to where it belongs,” he said.

In case the certificate is not renewed, the unionist said, this special group of people loses around 16 per cent of their basic salary.

He observed that a person living with disability is first required to go to a nearby hospital where they get a recommendation letter, and then wait to be invited to the National Council of Persons Living with Disability where they are issued with a certificate.

Torome requested Members of parliament to champion the revision of the bill in parliament.

“This is not only affecting teachers, but all employees who live with a disability who are required to renew their certificates every three years,” he said.

Among the things required when registering for an income tax exemption for persons living with disability are a medical report, a letter from the employer, disability membership card, and a tax compliance certificate.

When the council receives the application, it arranges for the vetting committee to assess the applicant and give a recommendation to the commissioner on the applicant’s eligibility for income tax exemption.

The commission ascertains the correctness and completeness of the application and if satisfied, a tax exemption certificate is issued.

When the application is not approved, the applicant, if dissatisfied, may appeal to the Cabinet Secretary for the National Treasury.

By Ann Salaton