Kenya Revenue Authority has introduced online Alternative Dispute Resolution sessions to safeguard taxpayers during the COVID-19 pandemic.

According to a statement sent to media houses today, Kenya Revenue Authority (KRA) has continued establishing measures to support taxpayer access to all essential services online.

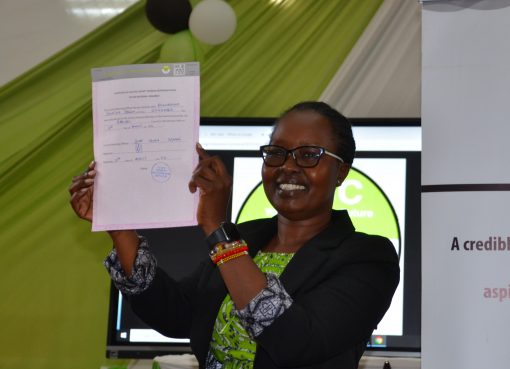

“The ADR sessions can now be held, uninterrupted through virtual facilities. The facilities bring together the taxpayer, the assessing Commissioner and a facilitator who chairs the session as would happen in a face to face ADR session,” read the statement signed by Deputy Commissioner for Tax Dispute Resolution Ms. Risper Simiyu.

Simiyu said that this means that taxpayers with disputes can still be heard and get solutions without physically attending ADR sessions, adding that the online session is cost effective and convenient to taxpayers as it covers a larger geographical area with the option of multiple individuals at different locations dialling in.

“KRA can now connect with taxpayers and their agents from the comfort of their offices or homes through video/teleconferencing technology applications such as Zoom, Skype or Google hangouts to ensure business continuity, whilst keeping the safety and security of these platforms in mind,” said Simiyu.

Ms Simiyu further observed that, “KRA has not been left behind in the use of technology as a business continuity model. We encourage parties with tax disputes, i.e. assessing Commissioners and taxpayers together with their agents to continue engaging virtually under the ADR framework. ADR is cost effective, presents an opportunity for faster resolution of tax disputes, improves compliance and preserves the relationship between the disputants.”

She further explained that ADR was rolled out in June 2015 to complement litigation by providing amicable and timely settlement of tax disputes. Since its roll-out, ADR has seen an increase in efficient and amicable settlement of disputes.

“The 2018/2019 financial year saw the sharpest spike in ADR applications where 502 applications were received. Of the 502 applications received, 237 cases with a revenue yield of Sh8.1 billion were successfully resolved,” she observed.

According to her statement, this was a phenomenal improvement compared to the 2017/18 Financial Year where 90 cases were resolved with a yield of Sh3 billion.

An analysis of the number of resolved cases in the two financial years indicates an increase of 147 cases, which translates into a 263 per cent increment.

“Apart from the number of cases, the resulting revenue implication has been equally enormous. A revenue increase from Shs 3 billion in 2017/2018 Financial Year to Shs 8.1 billion in 2018/2019 Financial Year is definitely no mean feat,”Simiyu said.

The increase in the number of applications and resolution rate indicates that ADR has increasingly gained acceptance, traction and public confidence thereby becoming a preferred avenue for tax dispute resolution.

By Alice Gworo