Kenya Revenue Authority (KRA) has introduced the Electronic Rental Income Tax System (eRITS) to simplify rental tax payments so as to enable landlords and property owners across the country to pay their taxes with greater ease.

Leveraging KRA’s Gava Connect, eRITS provides a technology-driven solution for the real estate sector, simplifying monthly rental tax payments for landlords.

KRA developed the eRITS system to encourage voluntary tax compliance within the real estate sector and reduce the administrative complexities of taxation.

The system provides a unified platform for landlords to compute, file, and pay their rental taxes, seamlessly connecting with the KRA’s digital ecosystem.

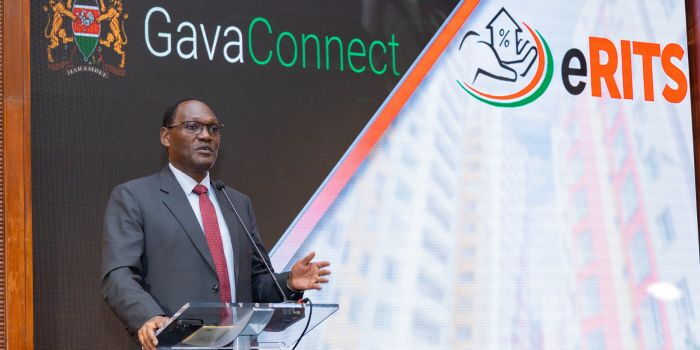

Treasury Principal Secretary Chris Kiptoo attended the launch on Thursday recognising eRITS as a key advancement in the government’s efforts to create a fair and efficient tax system for national development.

Speaking during the event, the PS affirmed that eRITS will drive efficiency within the tax system, ultimately benefiting all Kenyans.

“Our commitment is to a fair and user-friendly tax system and eRITS represents our move to a more efficient and beneficial structure for everyone. This platform aims to boost revenue and establish a stable and fair tax environment that serves the interests of both taxpayers and the government.” He explained.

On his part, KRA Commissioner General Humphrey Wattanga said eRITS was a voluntary compliance tool to improve tax compliance for rental properties, showcasing KRA’s commitment to service, efficiency, and improvement, an initiative that reflects the government’s commitment to fostering a future where tax compliance is viewed as a collective contribution to national development, rather than a burden.

Property owners can access the eRITS system by logging into either the Gava Connect API portal for system integration or the eCitizen platform.

Since its introduction in 2016, the Monthly Rental Income (MRI) tax has applied to landlords earning between Sh288,000 and Sh15 million annually. Effective January 1, 2024, the tax rate decreased from 10% to 7.5%, showcasing the government’s commitment to easing taxpayer burdens.

MRI tax revenue reached Sh14.4 billion in the 2023/2024 financial year, representing a 5.2percent year-on-year increase from Sh13.6 billion and Sh12.3 billion collected in the two prior financial years.

By Hellen Lunalo