The government will enhance the Hustler Fund and introduce a new product targeted at those who constantly borrow and repay promptly without exceeding the repayment period.

Ministry of Co-operatives and MSME’S Development Cabinet Secretary CS Wycliffe Oparanya said that they will introduce a new product that is the Savings-Loan Portfolio for the two million Kenyans who have been borrowing and repaying consistently from the Hustler Fund and from this new product the borrowers will be able to progress to the commercial banks and borrow bigger amounts.

“There are two million Kenyans who repeatedly borrow from the fund on a daily basis and these are the ones benefiting from the essence of this fund which is focused on ensuring that Kenyans at the bottom of the pyramid who did not have access to financing can be able to borrow and establish or grow their small businesses,” said the CS.

He explained that once the borrowers grow their business they can access bigger funding from government institutions including the Kenya Industrial Estates which gives loans of up to Sh20 million at 10% interest rate, the Kenya Development Corporation (KDC), The Agricultural Finance Corporation (AFC) among others.

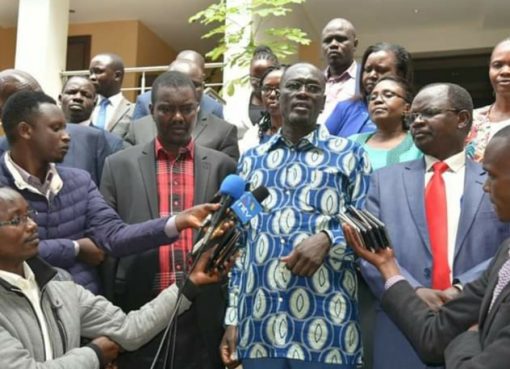

Speaking on Tuesday during the official rebranding of the Safaricom Investment Co-operative’s into the SIC-Investment Co-operative, Oparanya explained that the Hustler Fund has disbursed Sh57 billion to 22 million Kenyans and out of that Sh44 billion has been repaid with around 13 billion yet to be repaid.

The CS highlighted that in consultation with the service provider they are coming up with other innovations to make sure that those who have borrowed the money repay it so that other Kenyans can also benefit from the same fund.

Oparanya said that when they realized that people were struggling to repay the minimum amount of Sh500 they reduced it to the current Sh100.

“This year the government has provided Sh3 billion to be invested into the Hustler Fund,” Oparanya said.

The CS explained that co-operative societies play very important roles in produce aggregation, primary processing, transport, marketing, savings mobilization, and financial inclusion; with a remarkable track record in all sectors of our economy.

“As per the International Cooperative Alliance (ICA) and Cooperative Alliance of Kenya (CAK), there are approximately three million cooperatives in the world, with Kenya having over 25,000 registered cooperatives that have a membership of over 14 million people. Cooperatives, in general, contribute approximately 30 percent of Kenya’s annual savings, while generating employment opportunities for over 500,000 people directly and over two million indirectly,” explained Oparanya.

He added that the government of Kenya recognizes the co-operative sector as a critical player in pursuit of Kenya’s socio economic growth, equity, and sustainable development. As such, cooperative societies have been identified and prioritized as key enablers of the financial inclusion aspiration of the government as envisioned in the Bottom-Up Economic Transformation Agenda (BETA).

State Department for Co-operatives Principal Secretary Patrick Kilemi said that in the past Kenyans investing in real estate and land have suffered in the hands of rogue institutions like Mboi Kamiti but Safaricom Investment Cooperative has changed this by delivering property worth Sh10 billion to its members.

Kilemi said that since independence the banking sector has delivered 30, 000 housing mortgages compared to Sacco’s which according to records released from the Sacco Societies Regulatory Authority (SASRA) have assets worth over Sh1 trillion with about 50 percent of what people borrow going into buying land and building houses.

“I would like to appeal to SIC Investment Co-operative to invest in the affordable housing segment to complement the government’s efforts in solving the housing challenges facing the country,” said Kilemi.

He explained that in the Co-operatives Bill 2024 which is currently in parliament they are proposing clear demarcation between Sacco’s, Transport cooperatives and Investment cooperatives.

Safaricom Investment Cooperative CEO Churchill Winstones said that the re-brand process entailed market, audience, and stakeholder engagement, which was aimed at achieving an efficient and solution-oriented client experience, as the Society strives to align with the ever-evolving market trends shaping the current investment space.

“We understand that client choices constantly keep changing and evolving, driven by shifts around the world, technological advancements, and global events leading to a change in consumer behaviour,” said Winstones.

“By rebranding, we strive to ensure that our Society aligns with the evolving business landscape and that our brand image resonates with the values and expectations of our target audiences. We remain committed to providing superior returns to our investors and growth opportunities to our staff, and we will not relent on our determination to invest sustainably,” he added.

By Joseph Ng’ang’a