Kenya Commercial Bank (KCB) recorded a total revenue of Sh9 billion from digital channels during the 2021 financial year.

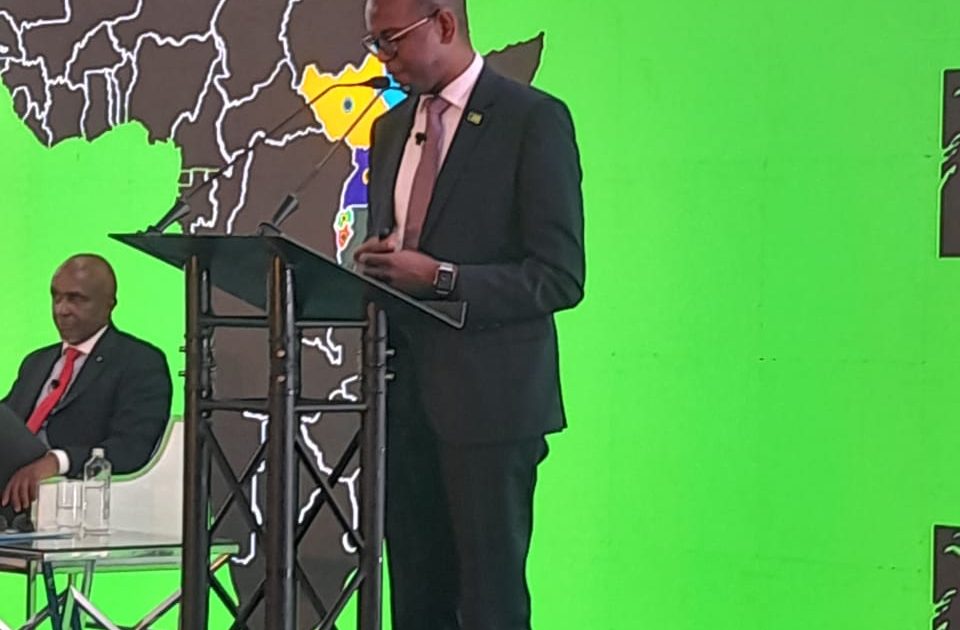

Announcing the results at KCB Kencom House in Nairobi, KCB Group Chief Executive Officer (CEO) Joshua Oigara, said the achievement was driven by efficiency through non-branch channels as the bank’s aspiration has always been to deliver the very best customer experience.

“In 2021, we recorded a steady improvement in customer satisfaction driven by investment in self-service channels,” said Oigara.

He noted that KCB aspires to be a game changer in efficiency and productivity, scale higher to regional relevance and to be a digital leader globally.

The CEO stated that the bank has supported the Small and Medium Enterprises (MSMEs) by revising the lending criteria to support the business.

“The Group has also participated in risk sharing guarantee to de-risk growth of investments,” he added.

The CEO said that the Group has been building momentum from regional businesses, which has led to commendable improvement in the Tanzania and Rwanda market.

Oigara stated that KCB has managed to embrace diversity at the workplace and has supported the education sector by providing scholarship programs to students.

Speaking at the event, the KCB Group Chairman Andrew Kairu, said the Group issued loans to the MSMEs as well as the women owned businesses to support them during the Covid-19 pandemic.

He said the bank has plans of expanding its services in Democratic Republic of Congo to tap into the various business opportunities.

Kairu stated that the Group plans to merge KCB capital with the subsidiary National Bank of Kenya to create wealth, asset management and custodial services.

In his remarks, KCB Group Chief Financial Officer (CFO) Lawrence Kimathi said that in 2021, there was an increase of mobile loans to consumers by the bank adding that the increase was driven by limit enhancement for qualifying customers.

He stated that the organization showed a strong growth in group profitability from the previous year.

“The growth was driven by increased income from loans, investing in government securities, foreign exchange and decline in the provisions charge,” said Kimathi.

The Financial Officer said that the majority of 2021 targets were achieved in a tough operating environment and hopes for more ambitious growth prospects for the future.

By Manu Mumba and Hannah Njoki