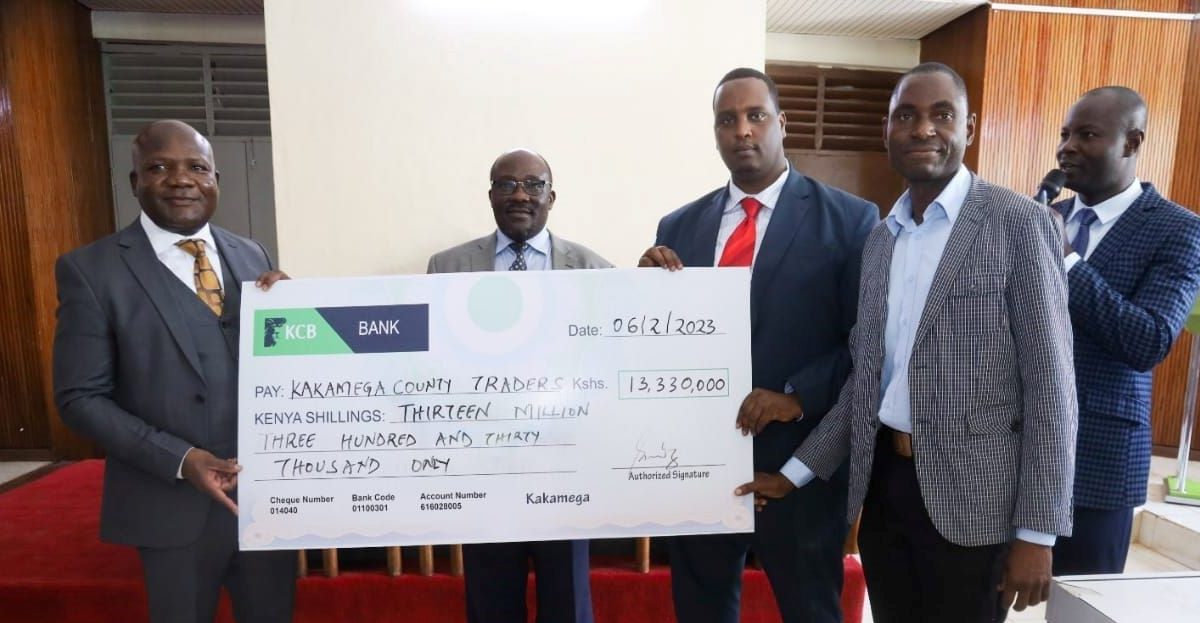

Kakamega County Government has disbursed Sh13.3 million worth of loans to traders through the Kakamega Microfinance Corporation.

Governor Fernandes Barasa said the county government has also allocated Shs115.5 million to the corporation in the 2022/2023 financial year to lend to Kakamega residents to boost their businesses.

Out of the allocated amount, the county government has disbursed Shs23.2million to the lending institution. He said the corporation has disbursed 1092 loans worth Shs116million to date with the absorption rate of the loans standing at 20 per cent.

“We are at Shs49.3million as far as performing loans are concerned and non-performing loans are Shs.28.2Million,” he noted. He said loans from the corporation are payable within 12 to 48 months at an interest rate of 8per cent on a reducing balance.

“Equity Bank started as a Microfinance Institution (MFI) and now is a leading bank in Kenya. That is our dream of taking our microfinance to be a bank,” he noted.

By Moses Wekesa