Plans are underway for the Industrial Bank (DB) to support Small and Medium Size Enterprises in Busia County.

This comes after the request by Governor Sospeter Ojaamong for the Institution to partner with the County in order to promote the development of SMEs in the County.

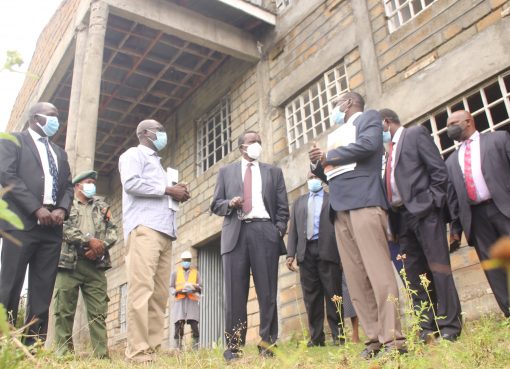

Speaking to the press after a courtesy call to Busia Deputy Governor Moses Mulomi , the IDB Strategy and Business Development Manager Morris Kathata said that the financial institution is keen on availing credit facilities to private investors in the County’s investment opportunity especially along the Big four agenda related projects.

Kathata added that the Bank will work closely with the Busia Government and the Kenya National Chamber of Commerce and Industry Busia Chapter in identifying SMEs to benefit from funding along the County’s areas of interest.

He noted that the County had made many strides in empowering production of Agricultural produce adding that there is need to move to the next stage of production.

‘The County is now ripe to get to the next stage of value addition as well as establishing industries that are keen on supporting farming like animal feeds production,’ he said, adding that investment in value addition will motivate farmers to enhance their production.

The Deputy Governor welcomed the initiative, adding that the move by the bank to fund the purchase of equipment and avail funds to rice farmers in Bunyala will help them engage in value addition.

Mulomi stated that the County’s leadership will explore ways of availing land at Alupe for the construction of an Industrial Park which will change the County’s economy.

“An investor keen on starting an animal feed plant has already submitted his application,” he said, adding that IDB will also provide funds for the proposed fish processing plant at Busia Trans-shipment market.

The Deputy governor further said that the bank has also identified three hotels to be installed with ultra-modern facilities.

The KNCCI Busia Chapter Chairman Sylvanus Abungu said that the proposed Industrial Park will see 60% of the local SMEs benefit, adding that a section of the SMEs has already benefited from Sh15 million funding from the County’s partnership with the MasterCard Foundation.

“Small businesses especially within the informal sector have been a key contributor to the country’s economy, accounting for close to 30 %,” he said, adding that poor access to credit facilities has however been a challenge for the past three years, due to the rate cap regime where banks categorised small business owners as risky borrowers.

By Salome Alwanda