The government is planning to revitalise the cooperative movement in the country through the development and implementation of several legal frameworks to address challenges that have been facing the sector.

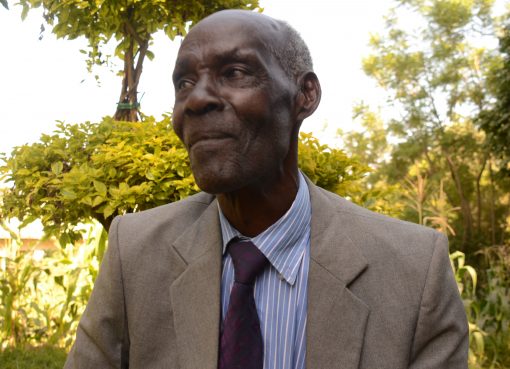

Cabinet Secretary for Cooperatives, Micro, Small, and Medium Enterprises (MSMEs) Fellow Certified to Practicing Accountants (FCPA) Wycliffe Ambetsa Oparanya said the government is on the verge of finalising the Cooperatives Bill No. 7 of 2024 that will enhance governance and legal collaboration between the National and County Governments.

Speaking during the 3rd annual cooperative movement’s stakeholders meeting in Naivasha, the CS said the Commissioner of Cooperatives was also coming up with a policy that will streamline operations in the cooperative sector and enhance accountability and transparency in the sector.

Oparanya noted that some Savings and Credit Cooperative Societies (Saccos) have been sacrificing professionalism and accountability at the altar of huge dividends to the extent of borrowing to pay the dividends and even declaring dividends from losses in order to make members believe that their Sacco was financially sound when, in the actual sense, they are struggling.

“It is essential to instill “good dividend manners” within cooperatives. Prioritising long-term sustainability over short-term benefits ensures cooperatives remain financially robust and capable of meeting members’ future needs. To this end, my ministry, through the Commissioner for Cooperatives Development, is developing a dividend policy to address the issues of malpractice in the sector.”

He was categorical that the legislation that is coming up on the floor of the House will help end these malpractices.

The cooperative movement, Oparanya said, has witnessed remarkable growth, contributing significantly to job creation, wealth generation, financial inclusion, and community empowerment. With over 14 million people engaged as cooperators and more than 500,000 employed in the sector, the role of cooperatives in shaping our nation’s prosperity cannot be overstated.

“To this end, this forum presents an invaluable opportunity to align our efforts, refine strategies, and reaffirm the movement’s central role in driving sustainable development through this sector.”

The CS also noted with concern that despite many cooperatives upholding their values, a few have failed to adhere to good governance principles, resulting in financial losses and eroding public trust. This, he said, tarnishes the reputation of the entire movement, overshadowing the remarkable efforts of cooperatives committed to improving their members’ livelihoods.

He at the same time noted the government is working on a framework dubbed “Mwongozo” for Cooperatives” an initiative that aims to promote transparency and accountability as well as training and capacity-building manuals to instill and enhance leadership skills among cooperative members.

According to the CS, the ministry is relooking at the Sacco Societies Act to be amended to establish a central liquidity facility and shared services platform to streamline the financial sector.

Further, Oparanya said in order to safeguard the members ‘savings, the operationalisation of the Deposit Guarantee Fund (DGF) is underway to address the challenge of mismanagement of depositors` funds that has threatened to cripple the movement.

He, on the same note, challenged the cooperative movement to embrace technology in their operations, urging them to opt for shared platforms that will ensure they remain competitive and resilient in this digital era.

The CS further disclosed that the Saccos were owed over Sh600 million in members` contributions, with the biggest defaulters being county governments and public universities, and this has greatly affected the performance of these entities.

Oparanya highlighted the coffee sector’s debt of Sh9 billion, which the government promised to waive but only received Sh2 billion from the Treasury, limiting its ability to address the issue.

He reminded his audience that the financial landscape is evolving rapidly, and cooperatives must adapt to remain sustainable. Mergers offer an effective solution, enabling cooperatives to pool resources, enhance operational efficiencies, and achieve economies of scale.

He added that by joining forces, cooperatives can deliver better services, expand their competitive advantage, and provide greater returns to their members.

“While financial sustainability is vital, the cooperative principle of service to members must always take precedence. Let us uphold these values by promoting responsible borrowing and ensuring financial discipline among members.

These reforms aim to create an enabling regulatory environment that fosters growth, sustainability, and resilience within the cooperative sector.

Oparanya also urged all stakeholders to align their strategies with the emerging policies and legislative frameworks, including the anticipated enactment of the Cooperatives, Coffee, and Sacco Societies (Amendment) Bills.

SACCO Sub-sector is a key player in realisation of vision 2030 of mobilising savings for Kenya’s investment needs. There are 5,000 registered SACCOs with over 230 operating Front Office Service, and these are the ones that are regulated.

To show the growing trust that Kenyans have in SACCOs as a reliable financial solution, deposits saw a strong surge, growing by 9.95 per cent from Sh620.45 billion from the previous year to Sh682.19 billion in 2023.

Kenya is ranked number one in Africa and seventh in the world on the strength of savings in excess of Sh680 billion, which is 35 per cent of total savings. Savings and credit cooperative societies (Saccos) alone have close to Sh390 billion in deposits (savings).

Research by the International Labour Organisation (ILO) indicates that about seven per cent of the African population is affiliated to the cooperative movement. The report also revealed that total membership among the 357-regulated SACCOs increased by 6.57 per cent, reaching 6.84 million members in 2023, up from 6.42 million in 2022.

However, the report indicates that the figure represents just under 30 per cent of the total adult working population in Kenya, indicating significant potential for further growth, especially if this sector can be revitalised.

A report from the Ministry of Corp shows that as of June 2020, the number of cooperatives in the country stood at slightly over 25,000 with a membership of over 14 million, employing 63 per cent of Kenyans directly and indirectly. Mobilised savings from this sector stood at Sh7.32 billion, which is over 30 per cent of national savings. The study found out that indeed cooperative societies are faced with challenges of leadership, political interference, and financial management.

By Mabel Keya – Shikuku