Uasin Gishu County is promoting partnerships with various financial institutions to boost Agribusiness in the county and facilitate a conducive environment for business and investment.

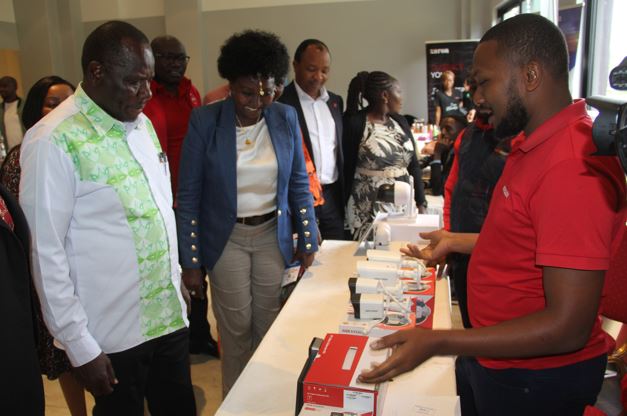

Speaking during Absa Bank business forum held in Eldoret, with the theme “Building Resilience for Business Continuity in Times of Uncertainty,” Governor Jonathan Bii lauded the Bank’s move, noting that business is key as it contributes to growth and development of the City.

“The theme underscores the importance of resilience in today’s challenging environment, as reflected in Absa’s presence in our thriving city. While we work to strengthen our structures to protect business clients, uncertainties do persist,” Bii noted.

“For instance, we all remember the recent rise in fuel prices from Sh120 to over Sh200 per litre impacted both the country and our county, yet many businesses demonstrated remarkable resilience in adapting to these conditions,” explained the governor.

He pointed out that his administration has implemented structures and systems to empower businesses like the recent business mapping, which identified over 47,000 businesses actively operating within the county, with 45,000 of these being micro-enterprises.

This data highlights an urgent need for enhanced collaboration to support these businesses through capacity-building initiatives and incubation programmes.

Additionally, instead of increasing fees and levies, the county is lowering them enabling the young and hardworking people to budget more effectively and save.

“For example, we reduced the boda-boda fee for stickers from Sh600 to Sh400 within the CBD, taxi sticker from Sh2500 to Sh2200, easing the burden on operators. This reduction, notably, led to an increase in our own-source revenue hitting a record Sh1.4 billion as more young people embraced this platform,” said Dr Bii.

He acknowledged hardworking farmers, who are pivotal to advancing the agricultural sector and ensuring food security, noting that they have strengthened last-mile fertiliser distribution through their stores, allowing farmers to increase yields with timely access to inputs as part of resilience-building efforts.

The governor mentioned that they recently launched an agripreneur model while at the same time deploying 210 officers across the wards to directly support farmers.

The administration is also providing farmers with free coffee, pyrethrum, and avocado seedlings. This initiative is enabling farmers to diversify their crops, promoting sustainability and resilience within our agricultural sector and promoting agribusiness through cash crops.

He called on the financial institution, to enhance insurance for the crop farmers as part of cushioning them from emerging disasters and calamities like the post-harvest losses which account for 30 percent of the harvest.

The governor urged farmers to consider insuring their ventures to safeguard against unforeseen challenges and to consider the right timing and rationale for each agricultural decision.

He further encouraged the young people who make up 62 percent of the Kenyan population and who are in for digital solutions, to embrace the ICT skills to do business.

Dr Bii reiterated the need to have the youth trained on financial literacy, mentorship and coaching before giving them funds to engage in profitable business ventures.

“We are building structures and systems to empower the business community. One of the most successful initiatives is the establishment of our state-of-the-art Service Centre which has reduced the time spent by clients in seeking services,” alluded the Governor.

Chief Officer for Trade Victorine Kapkiai outlined initiatives by the County to enhance the ease of doing business and incentives available.

She underscored that the county supports the business communities by facilitating access to capital through Inua Biashara Fund, Women Enterprise Fund and at the same time developing market spaces like the upcoming Export Processing Zone (EPZ) and the County Aggregation and Industrial Parks (CAIPs) and playing a key role in regulating the business to ensure fairness.

Absa Bank Regional Manager Julius Songok said the Bank has adequate finances set aside to support the businesses realise growth and sustainability in their various sectors.

He pointed out that the financial institution supports partnerships to boost agribusiness which is key in ensuring food security of the country.

“Agribusiness in this county is prospering, in terms of increased productivity despite the post-harvest losses which account for 30 percent of the harvest,” Songok said.

He emphasised the need for reducing post-harvest losses through embracing technology while at the same time encouraging more partnerships in this area.

The Manager affirmed Absa’s commitment to supporting agribusiness and providing the right solutions for farmers through access to information for farmers, access to mentorship and coaching programmes, risk management and insurance to ensure farmers are protected in case of any eventuality.

By Ekuwam Sylvester and Judy Too