Mr Kamunye Kahande, (not real name) 68, tethers his dairy cow to a coffee plant to feed on the sprawling grass in his once prosperous coffee farm that is now a shadow of its former self.

Kahande, from Murang’a County where political icons, the late Kenneth Matiba and Charles Rubia were born and brought up, is famously known as Wakahua (the coffee man) by the locals.

He was once the proud owner of a plantation of healthy coffee bushes that enabled him to sustain and educate his children and live a comfortable life.

Wakahua reminisces the days when his farm was the darling of many farmers from far and wide that has now turned to a grazing field for his cow and other wild herbivores.

Somewhere in the mid 1980’s, payments for his black gold disappeared plunging him into poverty.

The farmer is not alone and represents thousands of small scale coffee farmers nationally who found themselves in this state of affairs. They abandoned their crop and engaged in other activities like dairy farming to earn themselves some money to meet their financial obligations.

Wakahua, like other small scale coffee farmers, is hopeful that the radical measures being advocated by Agriculture CS Peter Munya to change the state of the coffee farmer sails through to revive the coffee sub sector.

Munya says if the proposals contained in the draft Coffee Bill 2020 are approved by the National Assembly and accented to by the President, the sector would take only a few years to again reclaim its glory.

Munya who recently spent three days in Nyeri County engaging farmers in public participation seeking their views on the proposed reforms, observed that coffee prices are good but somewhere along the coffee value chain, money is lost ending with farmers receiving peanuts or no payments at all.

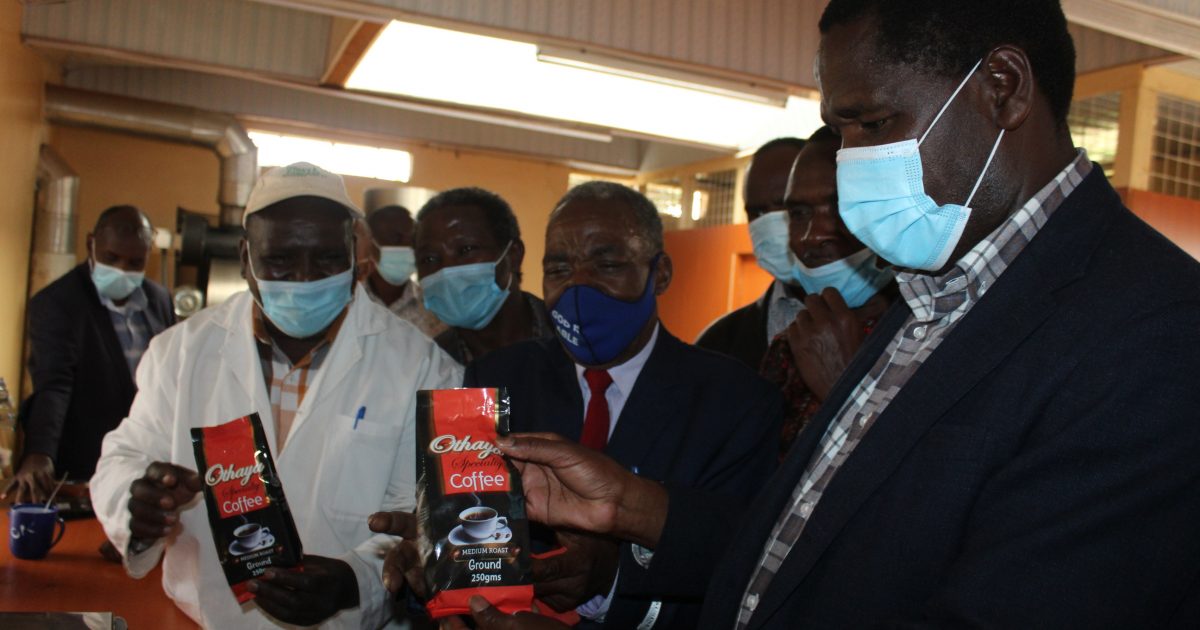

“There is no problem with coffee prices but somewhere along the coffee chain from production to farmers’ payment, a lot of money is lost. We want to reverse this and ensure farmers earn what they deserve,” Munya told farmers at Othaya Coffee Mills in Nyeri County.

His three days stay in the region saw him engage farmers from Nyeri Central, Tetu, Othaya, Mukurweini and Mathira sub counties who unanimously supported the proposed reforms.

Mr Munya said the government is determined to revive coffee farming at whatever cost adding,”We are investing heavily in the coffee sector so that farmers can have better returns to be able to eke out a living,” he added.

The CS said the government has released Sh3 billion as Cherry Advance Revolving Fund (CARF) to enable farmers to borrow money as they waited for the marketing of their coffee at a very low interest rate of three per cent.

However, Munya regretted that the majority of farmers have failed to borrow money from the CARF, frustrating the government’s effort to revive the ailing sub-sector.

“We have a Sh3 billion cherry advance revolving fund in the banks but farmers are not applying for it,” he lamented.

Mr Munya blamed the society officials for misleading the farmers to borrow loans in banks and private millers where they have personal interests. He noted that the banks and millers advance farmers loans at very high interest rates and this makes it impossible for them to pay up or make profits.

The Agriculture CS said to ensure total revitalization of the sector, the government has drafted proposals to streamline the sector. The proposals are contained in the Coffee Bill 2020.

One of the proposals is that farmers must be represented in all the coffee stages from milling, grading and marketing. Currently the farmer “fades” away after delivering his produce to a coffee factory.

It is through this coffee chain where farmers are shortchanged. Munya gave an example where during the grading process, a farmer is informed that about 80 per cent of his coffee is Grade C whereas it was grade AA and Grade AB that fetches a higher price than Grade C. The CS also cited instances where farmers’ money is stolen during coffee milling.

The proposed Coffee Bill fixes milling charges at 400 Dollars (approximately Sh40,000) per ton but a miller is at liberty to charge lower but not above that,” Munya told farmers at Mukurweini town during a public participation.

In the proposed Coffee Bill, millers and marketing agents are prohibited from lending to farmers.

“A Cherry Advance Fund is now operational specifically to lend to farmers and therefore millers and marketing agents may not lend any money to farmers. A miller or marketing agent who lends to farmers commits an offence,” Munya asserted.

This is one of the radical changes contained in the Bill, a departure from the past.

Other proposals include that factories will no longer be forced to belong to a larger society.

“Amalgamation of factories into cooperative societies was supposed to cut costs but this is not happening,” says Munya adding that the move will also help farmers who had abandoned their crop after their factories were caught up in debts accrued by cooperative societies without their consent.

Factory management will also find it hard to borrow money as the Bill prohibits them from using farmers’ assets as collateral for any reason. This is meant to protect farmers’ assets as some cooperative societies have found themselves under the threat of being auctioned due to debts.

A case in point here is the Rumukia Coffee Cooperative Society in Mukurweini, Nyeri County where officials borrowed a loan using the society assets and was recently threatened with auction by the financier.

Coffee factories will now appoint their own millers. This will be done annually by the members of a factory from a list of at least three millers. The millers will be allowed to make a pitch for their services to factory members indicating what their milling services cost and disclosing their milling losses.

Milling losses have been capped at 18 percent which have been benchmarked against New KPCU rates.

The CS says this will protect farmers from millers who manipulate milling losses and gave an example in Meru where some farmers had incurred milling losses of up to 24-25 per cent.

Munya says that some society officials have been obtaining coffee movement permits without the consent of farmers then moving the coffee to places they have interests and says this provision will address that.

The Bill also proposes the establishment of the Nairobi Coffee Exchange, as Coffee will be offered for sale through both auction and direct sales. Buyers will be required to remit money to marketing agents within 7 days for all bided coffee.

If they fail to do so, they will be penalized by meeting any difference in the value of coffee when it is re-offered for sale if it fails to realise the original bid value.

Those convicted of offences under this part may also have their licenses cancelled by the Cabinet Secretary. The coffee that is the subject matter of the offence is to be forfeited to the Board to be resold.

The payments for all coffee shall be done through the Direct Payments System (DPS) from which direct payments will be made to all those who have offered a service for the coffee: millers, marketing agents, coffee factories, estate accounts, and individual farmers.

The bill also re-establishes The Coffee Research Foundation as the Coffee Research Institute which will be autonomous in its operations, implementation of programmes, and in the allocation and management of its resources. It has been under Kenya Agricultural Research and Livestock Organisation.

It will be the lead agency in coffee breeding; in the developing climate-resilient coffee crop varieties and in leading the scientific effort to strengthen Kenya coffee resistance to diseases and pests.

But most importantly, the Coffee Research Institute will be the custodian of the Kenyan Coffee Genome and the primary instrument for making modern genomics.

Mr Munya told farmers that the Coffee Bill 2020 is now with the government printer and will thereafter be taken to the National Assembly for deliberations and further engagements with stakeholders.

He further says that the government will employ agricultural engineers in the grassroots to assist farmers in coffee production to increase yields on a three-year contract.

by Mwangi Gaitha