Equity Bank has officially announced the completion of acquiring some of the assets and liabilities of Spire Bank limited.

Spire Bank has had several setbacks and challenges in the management of assets and liabilities since 2014 until Equity bank stepped in the liquidation process in a structure set to ensure security of employees and its customers.

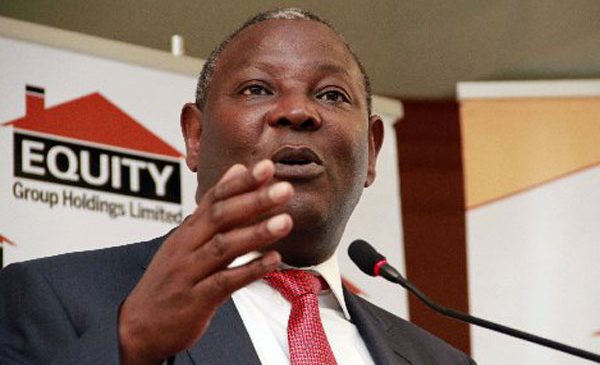

Equity Group Holdings Limited Managing Director Dr. James Mwangi speaking on Wednesday at the Equity Center stated that the bank has received deposits of over 20,320 new customers with a total transaction amount of Sh.1.322billion, adding that 3,700 and above loan customers had a transaction sum of Sh.945 million.

“Sh.8 million has been processed for more than 20 customers who have access across all Equity Branches in the country,” stated Mwangi. He said that the transaction was quite unique in the form of it being the first of its kind in the country to be consolidated at the customer level.

Equity bank limited has also supported and built Mwalimu Sacco in the Wings to Fly program which works hand in hand with other stakeholders and is currently supporting over 40,000 students.

Mwangi said that the capability of them solving a national crisis by acquiring the Spire bank has led to an open market mechanism and means of acquiring partnerships and collaborations in East and Central Africa.

“The transaction encouraged by the Central Bank of Kenya (CBK) is expected to strengthen the rapport between Equity bank and Mwalimu Sacco, a major shareholder of Spire Bank, and to act as a leverage in their domestic, regional and cooperative sector,” stated Mwalimu National Sacco, Chairperson Joel Gachari.

In addition, the Chairperson stressed that the Sacco has strengthened operations of the bank that are aligned within regulatory best practice to cut losses.

By Garvin Patrick and Phinta Amondi