The difficult business environment caused by hardships in marketing, competition, access to credit among many others challenges has forced several Small and Medium Enterprises (SMEs) to embrace the digital space to stay afloat.

During a symposium on Levering Digital Technology for Growth and Sustainability of SMEs at Mount Kenya University Thika main campus, the entrepreneurs said the growth of digital platforms has enabled them to be able to sell their products through social media platforms as well as access credit through digital applications, making operations effective.

They said the digital space has offered them a cheaper, more efficient options to operate to stay afloat.

The stakeholders led by Ellegent Credit Ltd Managing Director Harrison Mutegi said entrepreneurs have no choice, but leverage their business to digital technology if they are to remain competitive and cut lots of unnecessary costs.

He cited the use of phones to access credit from banks and other lending companies saying it has grown over the years among entrepreneurs due to its effectiveness.

“Those still stuck on traditional methods of business operations need to transition to more cost-effective tech-business models in order to beat the many challenges that they have been facing,” said Mutegi.

MKU Vice Chancellor Prof. Deogratius Jaganyi emphasized the power of online marketing, urging entrepreneurs to leverage digital platforms such as TikTok, Facebook, and Instagram to buy and sell products from the comfort of their mobile phones.

“SMEs are the backbone of Kenya’s economy, contributing over 30% of the GDP and employing millions. However, they face challenges such as limited access to finance, market constraints, and inefficiencies. Digital technology offers a transformative solution, fostering innovation, efficiency, and competitiveness,” said Prof. Jaganyi.

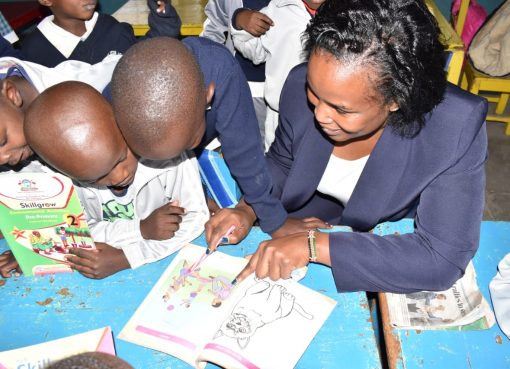

His sentiments were echoed by MKU Deputy Vice Chancellor Dr. Mercyline Kamande who highlighted that despite women leading in entrepreneurship, many struggle with digital marketing skills.

She attributed this to fears of cybersecurity threats and cyberbullying, which discourage them from utilizing online platforms. However, she noted that the symposium was a significant step in equipping women with the necessary digital skills.

“In this training, most women entrepreneurs admitted to challenges of leveraging their businesses to digital technology. They fear selling their wares online, or accessing loans through mobile banking apps due to cyber security. For growth, we need to transition to new models of business growth dictated by digital technology,” said Dr Kamande.

Financiers led by Kingdom Bank Thika’s Marketing Manager Kefas Mugambi acknowledged the financial challenges SMEs face, particularly in loan repayment noting that cases of loan default during this period of harsh business environment have gone up.

Shadrack Oguta, a Masters student in Business Administration at MKU urged his peers to take advantage of such training sessions to bridge the knowledge gap.

“There are fears among students who had dreams of establishing businesses over the difficult business environment.

However, they have the advantage of having digital skills and prominence in digital media which they tap into to grow their enterprises,” said Oguta.

By Muoki Charles