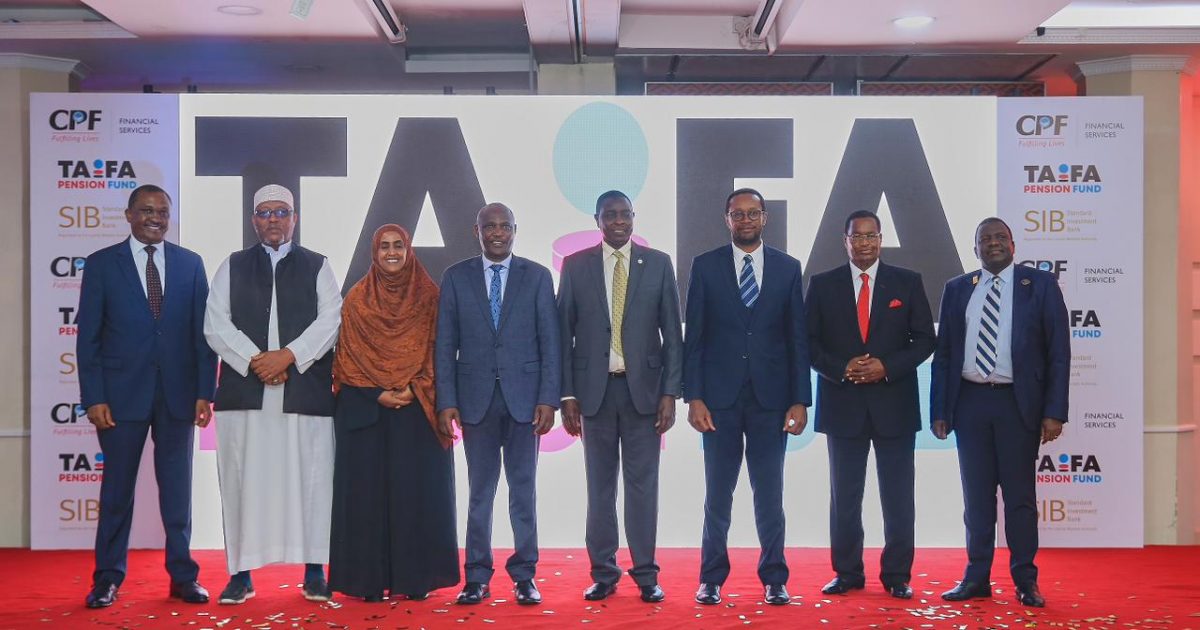

Central Providence Fund (CPF) Financial Services, in partnership with Standard Investment Bank has announced the launch of the Taifa Pension Fund, a scheme specifically designed to cater to the needs of Kenyan workers who do not currently have access to a pension plan.

The launch of the Fund presents a great landmark for CPF as the institution expands its reach to serve a wider segment of the Kenyan working population.

According to a press statement, the new scheme provides an inclusive and accessible pension solution to contribute to Kenyan workers’ financial security and well-being during their retirement years.

Further, the Fund is premised on the idea of pension funds aggregation – bringing many employers under one umbrella in order to realize benefits of scale and minimize costs.

Prime Cabinet Secretary Musalia Mudavadi noted that the launch of Taifa Pension Fund heralds a new era in Kenya’s social security landscape.

“This scheme aligns perfectly with our government’s vision of ensuring every Kenyan has access to a dignified retirement,” affirmed Mudavadi, adding that by leveraging CPF’s extensive experience and coupling it with modern, accessible solutions, Taifa Pension Fund has the potential to transform the retirement landscape for millions of Kenyans.

He commended the institution for this forward-thinking initiative and urged all employers to seize this opportunity to establish their employee’s financial future.

Meanwhile, the Fund, which is administered by CPF and managed by Standard Investment Bank as the pioneering Fund Manager, is a scheme for all Kenyans from diverse working backgrounds, in both the private and public sectors.

Furthermore, the Fund offers a comprehensive suite of benefits, including higher returns, global markets exposure, and diversified investment options.

As an umbrella fund, the scheme offers a cost-effective option for employers looking to establish employee pension benefits, pooling funds from participating employers to reduce the average cost per member in the scheme administration, an innovative solution seen as a testament to CPF’s shared dedication to providing world-class financial services that cater to the public’s evolving needs.

“Our decades of experience in the financial sector have equipped us with the knowledge and expertise to develop a pension solution that is not only reliable but also accessible to all Kenyans. We believe that a financially secure population is the fuel that drives economic prosperity. Taifa Pension Fund is a cornerstone in our mission to ensure that every Kenyan worker has the opportunity to build a prosperous future,” emphasized the CPF Group Managing Director/CEO Dr Hosea Kili.

At the same time, the new scheme empowers employers to plan for their employees’ retirement future with its customizable plans tailored to various income levels while offering its members unparalleled flexibility, and a comprehensive suite of benefits designed to ensure flexible retirement savings solutions.

With the option for a lump sum payout or lifetime pension plans, Kenyans can actively save for their future while enjoying the freedom to make additional voluntary contributions to meet their specific retirement aspirations.

By Michael Omondi