The County Government of Nyeri plans to increase the Enterprise Development Fund (EDF) from the current sh 76 million to sh 500 million in 2027.

Governor Mutahi Kahiga said this increase will help more micro, small and medium entrepreneurs to access affordable capital to expand their businesses.

Kahiga similarly said the county is planning to allocate a total of sh 80 million as loans to be disbursed through the EDF during the 2023/2024 financial year.

The loans which attract a 5 per cent annual interests’ rate and are payable within 24 months.

The minimum amount one can borrow is sh 50,000 with the maximum amount disbursed being sh 500,000.

The county boss said they are exploring the possibility of raising the maximum loan amount payable to sh 1 million in coming days.

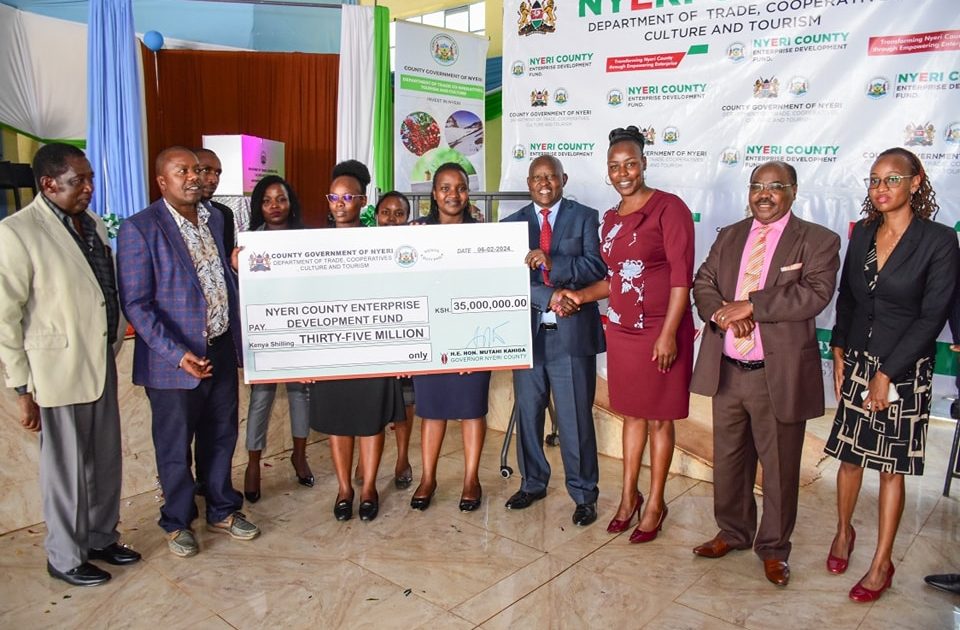

Kahiga made the announcement yesterday at the Nyeri Cultural Center while officiating the disbursement of EDF loans totaling to sh 35 million.

“Our collective vision is to grow the funds loan from the sh 76 million loan book to sh 500 million by the year 2027.Towards this end, my government has proposed to set aside an extra sh 80 million for the financial year 2024/2025.This will significantly help more micro, small and medium entrepreneurs to have easy access to affordable capital for their businesses growth and expansion,” he said.

“It is important to remind our micro, small and medium enterprises that the interest rates of our Enterprise Development Fund loans remain at five percent annually at reducing balance which is among the lowest rates in the country,” he added.

The County boss revealed that the fund had so far benefited a total of 232 small businesspersons since 2019 with this figure expected to take an exponential growth in coming years.

He also noted that out of those who have benefitted from this fund are youth at 25 per cent who are emerging as a key segment in the uptake of the loan facility.

This has in effect contributed to the economic growth of the county while at the same time creating income earning opportunities to upcoming young entrepreneurs.

“It is gives great joy that the initial capital has so far touched the lives of 232 beneficiaries, representing a diverse spectrum of our business catchment. Of these 52 per cent are male small enterprises ,46 per cent females, and one per cent represent medium business entities. The youth constitute 25 per cent of all our beneficiaries emerging as the dynamic force propelling the success of the enterprise we passionately support,” he pointed out.

In 2018 when Kahiga’s pushed for the amendment of then County Enterprise Development Fund 2015 Act which had glaring challenges and gaps and helped operationalize the amended law.

At the time the county allocated an initial sum of sh. 30 million into the fund but later appropriated an additional sh. 10 million bringing the capital injection to sh. 40 million.

While announcing the launch of the fund in April last year, Trade, Tourism, Culture and Cooperative CEC Diana Kendi noted that while the loan was geared towards economic empowerment among entrepreneurs it would also go a long way in addressing youth unemployment in the county.

Kendi said the majority of the young people in the county had sunk into the abyss of alcoholism and substance abuse out of frustration owing to dwindling income generating opportunities amidst a worsening global economic crisis.

The officer therefore said the revolving fund would play a pivotal role in creating income generating opportunities for young people and in so doing help address the rampant alcoholism in the county.

“We have seen an increase in alcoholism and substance abuse here in Nyeri and as a county government we have put different initiatives to curb this vice. One of the initiatives is of course to put a center that is supported by the health services to help those who are already addicted. However, what is really leading the youths into drug abuse is financial challenges and we found it fit to launch an empowerment program by providing affordable capital to start some small businesses payable within two years,” she said.

The revolving fund under the County Enterprise Development Fund (EDF) offers among others Business Expansion loans, asset financing, agribusiness funds at 5 per cent reducing balance within a period of 24 months.

The minimum amount of money individuals or registered groups can borrow from the kitty is sh 50,000 to a maximum of sh 500,000.

Cooperative societies on the other hand can access up to sh 1 million of the money.

Applicants interested in accessing the funds are advised to download and fill the application form from the Nyeri County Government website www.nyeri.go.ke.

Duly filled forms should thereafter be forwarded to the respective Ward administrator or area chiefs for processing.

Also present during the event included Deputy Governor Warui Kinaniri, Trade, Tourism, Culture and Cooperative CECM Diana Kendi, Chair of the Budget Committee at the County Assembly of Nyeri Gibson Wahinya among others.

By Samuel Maina