Credit Reference Bureaus have appealed to both business people and individuals to come forward and check status of their credit information.

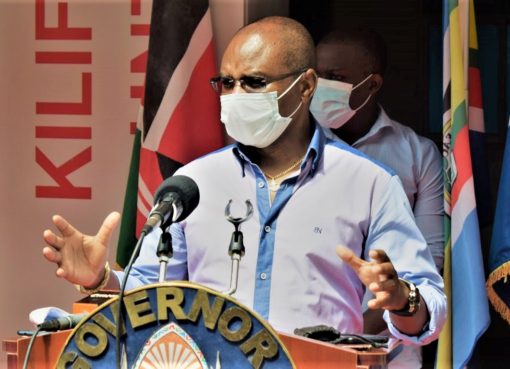

Speaking during a public awareness forum in Thika town, Metropol CRB Credit Manager Newton Karaba noted that not all Kenyans are conversant with how the CRB reporting system works, while discussion on what is described as ‘blacklisting’ has always been marred by misinformation.

“Being negatively listed on a credit reference bureau can be upsetting for most people. Most Kenyans especially the youth have expressed major concern at the slightest mention of the name CRB and it has long been assumed that those who have been negatively listed will be unable to obtain credit going into the future, which is false.

That’s why we have chosen to come out here and educate the masses on the importance of often checking their CRB listing, with a view to demystify the misinformation circulating about CRB’s,” he said.

CRB’s companies are charged with the responsibility of collecting credit information on borrowers, either businesses or individuals. Lenders submit details of borrowers to CRB’s in order to enable other lenders to access the borrowing history of a specific borrower to help determine their credit worthiness.

A CRB listing is very different from a negative listing, which basically refers to a situation, where a borrower has been reported for having a history of defaulting or failing to meet their credit obligations

“If your loan is negatively listed on CRB that would mean that it has been consistently been classified as non-performing for an extended period of time, where the borrower did not attempt to make any partial payments, while the loan was still active.

Consequently, it is unwise for borrowers to allow themselves to be negatively listed keeping in mind that the CRB shares their information with other lenders. Chances are that even when they clear the defaulted loans, next time they borrow, it may result in the defaulters being subjected to a stricter lending terms or being denied the loan all together,” said Karaba.

The Metropol credit manager said the ongoing campaign was an awareness initiative to sensitise not only borrowers, but all people on the importance of regular checking of their CRB listings as it gives a borrower an idea of what creditors see, when they apply for credit and it also helps individuals identify and remove potentially damaging personal and financial data caused by identity theft, errors or out of date entries.

A resident of Ngoingwa in Thika, Veronica Chege said she was happy to have finally understood what blacklisting actually means, while encouraging other residents to come out and check their listing status.

“Infact, I have now discovered I owe a certain lending institution money that I forgot to pay and since I don’t want to negatively affect my credit score, I have been instructed on how to clear the debt and ultimately clear my name from the CRB, which I intend to do as soon as possible,” she said.

Meanwhile, CRBs are regulated by the Central Bank of Kenya (CBK), which has the statutory power to issue on institutions that can submit credit reports.

According to Metropol CRB, a total of 19 million Kenyans have been listed in the Credit Reference Bureau database, which is about 66 percent of the adult population in Kenya.

The Credit Reference Bureau (CRB) reporting system has been the subject of a national conversation over the past one year, after President William Ruto’s administration announced plans to reform the CRB system to unlock access to credit for a larger group of Kenyans, as part of the bottom up economic agenda (BETA).

By Hellen Lunalo