The Central Bank of Kenya (CBK) is set to regulate mobile lending firms to ensure the services are in tandem with the law.

This follows complaints from customers that they are charged exorbitant interest rates by the firms.

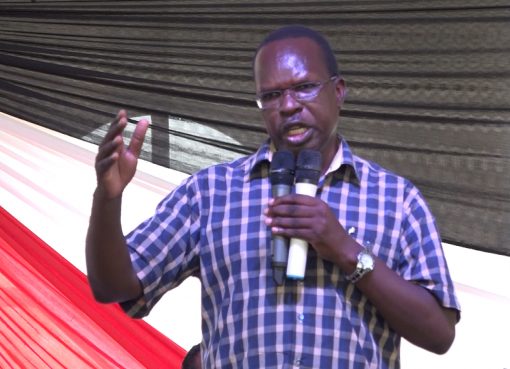

The CBK Governor , Dr. Patrick Njoroge who presided over the launch of a new app (STAWI) that targets Small and Medium Enterprises (SMEs) said most of the firms were behaving like shylocks.

Dr. Njoroge revealed that all operators shall be vetted before being cleared to ensure that customers are not swindled.

“Very soon you will start seeing CBK labels on the approved firms so that if you engage with those that are not dully certified, you know for sure that you are getting into trouble with the law,” he cautioned.

Speaking at Kondele in Kisumu city, the CBK Governor said the decision was reached after realization that the SMEs had been sidelined by commercial banks, in view of the interest rate capping.

The Chief Executive Officers (CEOs), Dr. Gideon Muriuki (Cooperative Bank), Jeremy Ngunze (CBA Bank), John Gachora (NIC), and Joshua Oigara (KCB) were among other dignitaries present.

Gachora disclosed that the SME loans ranges from Sh.30, 000 to Sh.400, 000 and urged local business entrepreneurs to sign up with Stawi app if they hope to fully utilise the opportunity to boost their businesses.

By Dorothy Otieno