The Agricultural Finance Corporation (AFC) has launched its 2023-2027 strategic plan dubbed, collective ambition for a thriving Kenyan agriculture.

The strategic plan is said to enhance financial inclusion, boost agricultural productivity and promote sustainable practices across Kenya’s farming communities.

The plan focuses on providing affordable credit for smallholder farmers, offering capacity-building programs to support modern farming techniques and improving market access.

The plan is also aligned with Kenya’s Bottom-Up Economic Transformation Agenda (BETA), emphasizing grassroots economic development and food security.

Speaking during the launch, Livestock Development PS John Mueke, underscored the ministry’s dedication to developing Kenya’s agriculture and livestock sectors.

“The Strategic Plan outlines our vision to increase agricultural productivity, promote climate-smart agriculture and improve access to finance for farmers,” he remarked.

The PS also announced that the AFC will receive Sh1 billion in the next financial year from the national government and a further Sh15 billion from Absa bank and to enhance financial access to farmers.

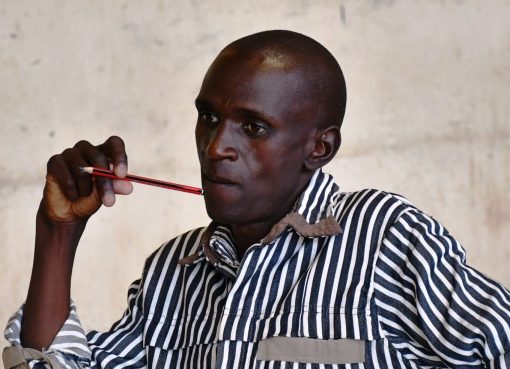

On his part, AFC Managing Director, George Kubai stated that the Corporation aims to tackle challenges faced by farmers nationwide by offering solutions to help them thrive.

“At AFC we are focused on tackling every farmer’s obstacle by giving them solutions to help them prosper,” he said.

Kubai further emphasized the urgent need to address climate change and affirmed the corporation’s commitment to integrating climate-resilient practices into the financing mechanisms.

“By promoting climate-smart agriculture, we aim to support sustainable agricultural development and help farmers adapt to and mitigate the impacts of climate change,” he said.

Kubai also indicated that special attention will be dedicated to small holder farmers, youth and women in agriculture to give them the necessary tools to prosper.

“Special attention will be given to supporting smallholder farmers, youth, and women in agriculture, ensuring they have the financial tools necessary to thrive.

To maximize our impact, we will upscale our wholesale lending model to account for 65 percent of our loan book, while dedicating 35 percent to retail lending,” he said.

Tamara Cook, CEO of Financial Sector Deepening (FSD) Kenya, announced that FSD Kenya is committed to supporting the Corporation in implementing its strategic plan.

“We will review current AFC business models to ensure alignment with the BETA Agenda and the fourth medium term plan (MTP IV) and develop new and innovative financing models that leverage digital technologies to improve access to finance for farmers, agri-MSMEs, youth, and other underserved groups,” Cook said.

The strategic plan is expected to significantly contribute to the country’s Vision 2030 and the Agricultural Sector Transformation and Growth Strategy (ASTGS) 2019-2029.

Meanwhile, by addressing the needs of small-scale farmers and focusing on sustainable growth, the AFC’s new strategic plan is poised to play a pivotal role in achieving Kenya’s economic and agricultural objectives.

By Sylvia Wanjohi