The beneficiaries of the government Youth Enterprise Development Fund have urged young people to apply for the various state-funded programmes to fully enjoy the benefits.

The government has rolled out various projects including the Uwezo Fund, the Youth Enterprise Development Fund and Ajira Digital to help the youths and women groups to access affordable loans to start businesses.

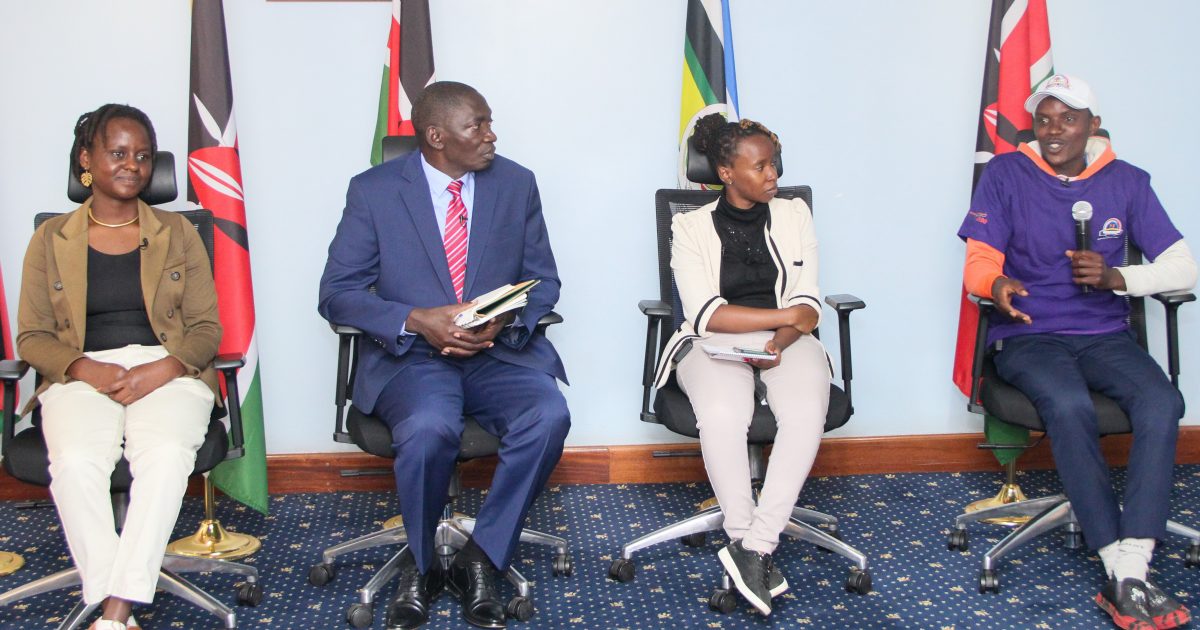

During the weekly interactive virtual meeting organized and moderated by the Office of the Government Spokesperson, Colonel Cyrus Oguna, four beneficiaries of these projects took the opportunity to sensitize the youths and provided testimonials on how they progressively used the loans disbursed to them.

“As a women’s group, we initially took Sh.100, 000 from the Uwezo Fund which we converted to table banking which made it essentially easier for us to repay the loans,” Charity Mugeli said.

Mugeli, the chairperson of Kiambu Women Group, further explains that the 10 per cent accrued interest from members’ loans aided them in clearing the debts within the stipulated six months period. Subsequent loans have enabled the group to purchase a piece of land in Gatuanyaga, Kiambu County.

Affirming the same position, Michael Njuguna a Sacco matatu driver, is successfully selling eggs as a side hustle within their 22-member group after receiving Sh.100, 000 loan.

Through Ajira Digital training and mentorship, Grace Mwai, is now an accomplished graphics designer and a successful social media marketer and developer.

Mwai is independently working online to create websites, personal profiles and social media management in organizations which earns her Sh.30, 000 per month as compared to the Sh.20, 000 she previously earned.

According to Mekatilili Mweru, the Youth Enterprise Development Fund offered her Sh. 2 million loan at a 6 per cent interest rate per annum with a flexible repayment period of six years, which is too low compared to the 18 per cent charged by commercial banks.

“Previously, I used to earn Sh. 60,000 from the sale of 600 broilers after six weeks, but since I received the loan, I am now able to generate Sh. 80,000 every two weeks from 1900 broilers,” Mekatilili expounded.

The University of Nairobi law student and farmer added that her previous prudent savings in the bank and a title deed she used as collateral enabled her to acquire the loan. The enterprise officers also teach the loan beneficiaries how to carry out sound financial management and mentor them on good business approaches.

Oguna pointed out that the Youth fund programmes have different requirements to qualify for a loan. He advised the young people and any citizen to register to learn and start earning through Ajira Digital, which is two days of training and one-month mentorship.

By Winnie Shanice and Rolex Omondi