Kenya Power and Lighting Company (KPLC) has released the unaudited financial results for the half year ended 31st December 2021 outlining its transformation journey as it marks 100 years of powering the economy and strengthening services to the customers.

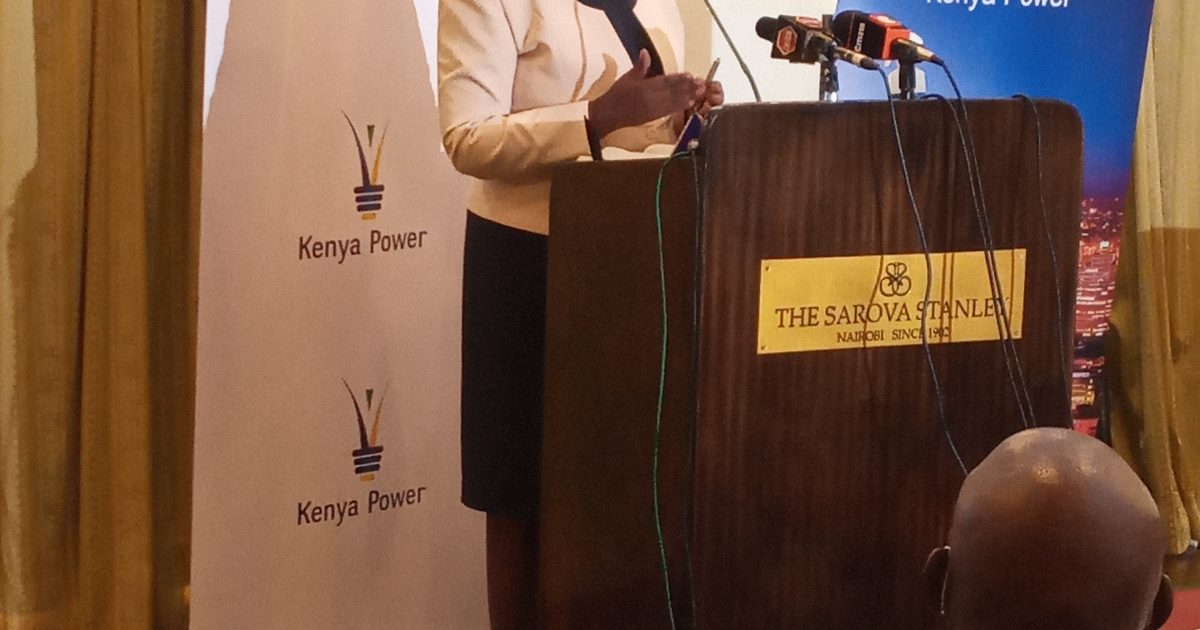

Speaking in Nairobi, the KPLC acting Managing Director (MD) and Chief Executive Officer (CEO), Eng. Rosemary Oduor, said that at the beginning of 2022, KPLC’s efforts were fully geared towards sustaining the momentum they started building in the previous financial year.

Oduor stated that the company has intensified its focus on the five core strategic areas which included growing sales, stepping up of revenue collection, enhancing system efficiency, managing cost, and improving customer experience to boost profitability which it achieved in the last financial year.

She added that the released unaudited profit before tax of Sh5.6 billion for the half year trading period ended December 31, 2021 is attributed to increased sales, enhanced system efficiency, and decreased operating cost.

On the business performance highlights specifically the electricity sales, the CEO said that the company’s sales recorded an 8.7 percent growth from 4,196 gigawatts hours to 4,562 gigawatt hours compared to a similar period last year due to an increase in customer connectivity, improved quality, and reliability of KPLC’s supply.

“This growth is due to enhanced preventive maintenance work, network refurbishment, and the accelerated replacement of all faulty equipment,” she explained.

The CEO stated that the enhancements combined with a 2.3.3 equipment in system efficiency which stood at 77.13 percent as at December 31, 2021 led to a 12.9 percent increase in electricity revenue which grew to Sh69.447 million.

“These developments resulted from enhanced field operations, installation inspections, removal of illegal connections, and replacement of faulty equipment,” Oduor added.

She added that the company would continue to manage its cost as it makes strategic investments in the network so as to increase reliability and continue to improve the connectivity process in order to enroll more customers to the grid.

Oduor revealed that the company closed the first half of the financial year with a cash position of Sh8.3 billion which included some refaced funds for the projects, receipts from the government on stream lighting programme as well as funds for scheduled bills repayment in the next period to avoid going for expensive debt.

To sustain good performance, the CEO said that the company would focus on dealing with complaints by improving the entire process end to end right from the meter installation, through reading of the meter to ensure the customer billing is correct and on time, to ultimately ensuring that the money billed out of the sales of electricity is collected on time.

While the current employee head count stands at approximately 9,800 staff members, Oduor disclosed that during the previous period, the staff post declined by Sh0.8 billion as a result of staff attrition which saw staff numbers reduced from 10,343 as per December 31, 2020 to 10,023 a year later.

“The finance cost during the period increased slightly to Sh6.8 billion from Sh6.6 billion mainly due to an unrealized foreign exchange,” she said, adding that the company cleared its over draft amounting to Sh3.6 billion.

Oduor revealed that the roll out of a proactive revenue collection strategy premised on prioritization of outstanding obligation to enhance the company’s cash position resulted in the company’s reduced trade and other payables by over Sh4 billion.

“The fuel cost related to generation increased from Sh4.6 billion to Sh10.9 billion due to the 314 gigawatt hours increase in the unit purchased from thermal plants up to 790 gigawatt hours. This is partly attributable to the low hydrology from the hydro stations due to the poor rainfall pattern and also the upsurge in the fuel prices,” she noted.

At the same time, KPLC acting General Manager for Finance, Stephen Vikiru, stated that both the total revenue and the cost of sales increased by 21 percent, the trading margin remained at 34 percent while the foreign exchange went up by 47 percent due to the volatility of the Kenya Shilling.

“When the volatility is high, the number also moves based on the behaviour of the shilling against the major currencies,” Vikiru said.

He noted that fuel cost charge increased by over 100 percent which was attributed to the increased uptake of generation for the plants due to the increased demand in areas where there is insufficient transmission capacity.

Vikiru further explained that the fuel prices have been on the upward trend and that there was transmission integrated interruption in December.

By Mary Wangari and Michael Mulinge