TransUnion, a global Consumer Credit Reporting Agency in partnership with FICO, an international analytics company have launched two innovative risk assessment products in the Kenyan market.

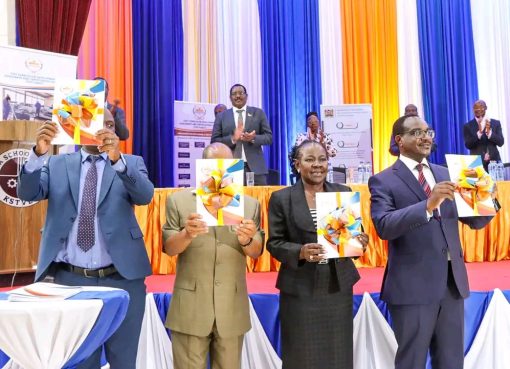

The two new products namely the FICO Score and Credit Vision Variables were launched in Nairobi to revolutionize the lending landscape by merging conventional and micro-lending data, risk profile analysis, and growing financial inclusion.

Speaking during the launch held at a Nairobi hotel, the Chief Executive Officer (CEO) Trans Union Africa, Lee Naik, said the new FICO Score, customized for Kenya, takes into account more than 145 data sources and 24 months of history to give a more detailed view of consumers’ credit behaviour.

Naik added that in contrast to conventional credit models, which tend to leave out informal borrowers, the new model takes into account a broader arrangement of financial transactions, making loans available to more people and small businesses.

In his remarks, the CEO of TransUnion Kenya, Morris Maina said the impact of the two innovations will be significant in giving lenders a better and more precise insight into the behaviour of borrowers, adding that they can drive economic empowerment and financial stability.

“This tech is especially relevant to Kenya’s booming digital lending market, where microloans and short-term credit are the bread and butter of financial inclusion,” stated Maina.

He added that conventional credit scoring systems that do not capture the real financial commitment of individuals have been a problem for many Kenyans, particularly those in the informal sector.

The Credit Vision Variables system provides a more granular risk model, enabling lenders to better serve and acquire new customers, strengthen risk management using predictive analytics, streamline loan disbursements, with 20-30 percent higher credit access and to enhance pricing models to render interest rates more affordable for creditworthy borrowers.

Maina further stated that for consumers, it implies aspects such as increased access to low-cost credit, a decrease in loan application denials and a more balanced lending engine that takes into account other financial behaviours such as mobile money transactions.

Kenya’s loan market is fast evolving, and mobile lending and microloans are dominating. As TransUnion’s Q2 2024 Consumer Pulse Study illustrates, 60 percent of Kenyans plan to seek new credit or roll over their loans within the next year.

“Many, however, remain excluded due to outdated credit scoring practices that fail to uncover the economic behaviour of holders of non-formal banking records,” stated Maina.

He noted that with the introduction of Credit Vision Variables, lenders are now able to more accurately predict customer behaviour, resulting in reduced loan defaults and a safer credit environment.

Maina pointed out that the launch of the technology also aligns with the Kenyan government’s push for financial inclusion to get more individuals into the formal financial system.

He said the launch is a bold step forward as it has made the financial system shift towards a more inclusive one as a result of the partnership.

The Head of Credit Trans Union Africa, Mr. Fatgie Adams, singled out fairness and data privacy in credit scoring as the most important issues for borrowers.

FICO’s scoring models have open algorithms that reveal the factors behind a consumer’s score which allows lenders to offer better terms to responsible borrowers while ensuring those with thin credit files are not unfairly penalized.

“We are dedicated to ensuring that our scoring models are fair, transparent, and data-driven, giving lenders and consumers an open and fairer credit system,” said Adams.

By Gabriel Mwangi and Vanessa Muhati