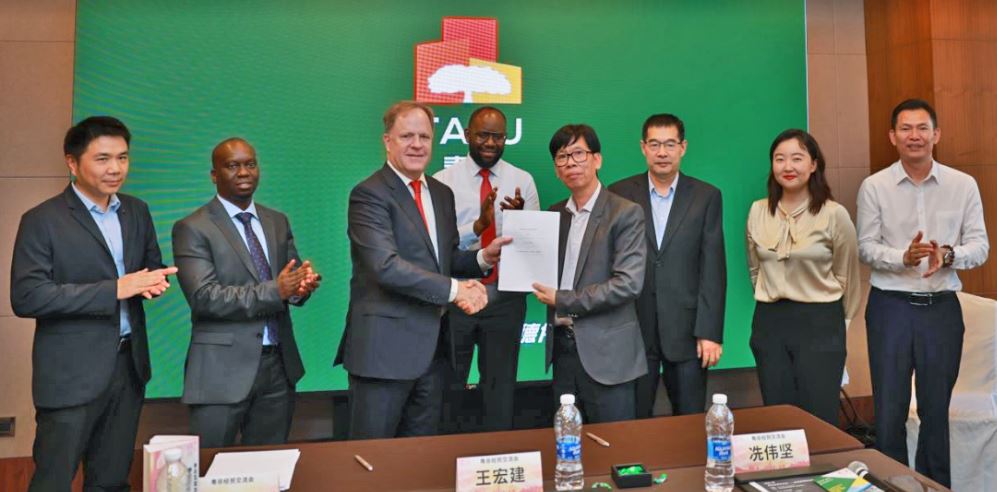

Tatu City, the 5,000-acre Special Economic Zone (SEZ), has signed a partnership agreement with the Kenya Guangdong general chamber of commerce to promote bilateral trade between Kenya and China.

The agreement, signed in Guangzhou, the capital of Guangdong Province, establishes links between Guangdong’s business community and Tatu City, which provides a seamless platform for market entry for Chinese companies into Africa.

According to Preston Mendenhall, Country Head of Rendeavour, developer of Tatu City, who was speaking to the media on Thursday in Kiambu town, Chinese companies are among the most active at Tatu City SEZ, the first operational in Kenya.

“We are seeing a surge in investment from highly entrepreneurial Chinese companies diversifying their global manufacturing bases to serve international clients,” Mendenhall said in a press release.

Kenya and Tatu City, he said, offer the perfect platform, with ample labour and easy access to international markets, as well as over one billion consumers on the continent.

The Kenya Guangdong General Chamber of Commerce Chairman, Kin W. Xian, said they were delighted to partner with Tatu City to support the achievement of their mission to promote economic cooperation, trade, and investment between Africa and Guangdong.

Guangdong Province, known as the economic powerhouse of China, ranks number two in exports to Kenya and number one in imports from Kenya, according to the Massachusetts Institute of Technology (MIT) Observatory of Economic Complexity.

MIT ranks countries based on the amount of useful knowledge embedded in them, and the ranking is based on the idea that a country’s economy grows as the complexity and specialisation of its products increase.

Last month, President William Ruto attended the 3rd Belt and Road Forum for International Cooperation in Beijing, where he signed 10 investment agreements with Chinese companies.

With more than 75 Kenyan, regional, and multi-national companies, Tatu City is Kenya’s first operational Special Economic Zone, offering low corporate taxes, import duty exemptions, zero-rated VAT, and zero withholding tax.

By Wangari Ndirangu